Launch of the 2022 IMF World Economic Outlook

2022-11-09 IMI On the morning of October 27, Launch of the 2022 IMF World Economic Outlook was held at Renmin University of China (RUC), jointly organized by the IMF Resident Representative Office in China, International Monetary Institute (IMI), and co-organized by ZhiXin Investment Research Institute.

Steven Barnett, Senior Resident Representative of IMF China, and Li Xin, Deputy Representative of IMF China, Torsten Ehlers and Charlotte Gardes, Senior Financial Sector Experts at the IMF’s Monetary and Capital Markets Department, Qian Zongxin, Associate Dean of the School of Finance of Renmin University of China, Lian Ping, Chief Economist of Zhixin Investment, Zhong Zhengsheng, Chief Economist of Ping An Securities, Lu Dong, Associate Professor at the School of Finance, RUC, Yang Zirong, associate researcher of the International Finance Department of the Institute of World Economics and Politics Chinese Academy of Social Science, and other experts and scholars from financial management departments, research institutes and financial institutions in Europe, the United States and Asia attended the meeting and made speeches. More than a dozen media participated. The meeting was chaired by Zhang Zhixiang, former Director-General, International Department, PBoC, and former IMF Executive Director for China.

Prof. Qian Zongxin made the opening remark, expressing his heartfelt thanks and warm welcome to all the guests. He pointed out that the World Economic Outlook has expected a declining global economic growth rate and a rising global inflation rate. As the global economy continues to face unusually high risks, policymakers should focus on restoring price stability and easing the pressure on living costs. He expressed in the conclusion that he looks forward to the further consolidation and deepening of the cooperation between the IMI and IMF and wished the conference a complete success.

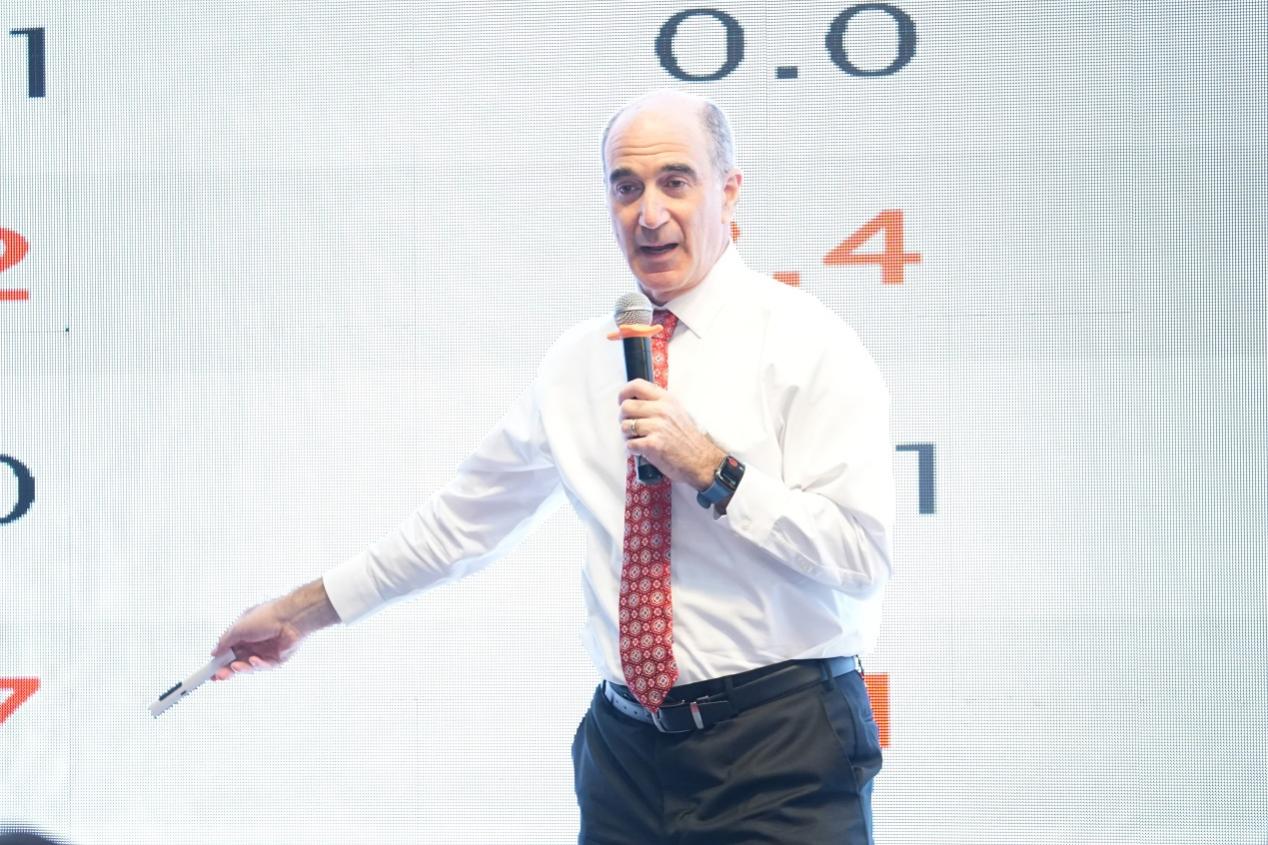

Mr. Steven Barnett was the first to deliver the keynote speech. He stated that the global economy is facing two serious challenges: inflation and low-income countries. The most important thing is to stabilize the macro economy. Judging from the volume of economies, the world can now be divided into two categories: developed economies, as well as emerging and developing countries. It is predicted that inflation will continue to rise. It is expected that inflation will fall back to the pre-pandemic level in December 2024. All central banks should take decisive actions to appropriately tighten monetary policy without affecting economic recovery. Against the backdrop of the pandemic, the world has entered the largest economic recession, with low-income countries and vulnerable economies suffering the most. Debt pressure and financing costs continue to rise. International organizations and developed economies should be called upon to take concerted action. The IMF has provided loans and assistance to troubled countries to help low-income countries achieve debt relief. Meanwhile, it has arranged a US$ 650 billion SDR policy, established a sustainable development resilience trust fund, and provided project-based loans to countries.

Next, Mr. Li Xin delivered a speech on the economic outlook of the Asia-Pacific region. He mentioned that the global economic forecast released by the IMF lowered the growth rate of the Asia-Pacific region to 4% this year and 4.3% next year, far lower than the average annual growth rate of 5.5% in the Asia-Pacific region over the past 20 years. Despite this, the Asia-Pacific region is still one of the bright spots against the backdrop of an increasingly gloomy global economy. China’s economy has been affected by the pandemic, downward pressure from the real estate industry and weakening external demand in 2022. The Chinese government have then adopted very strong fiscal and monetary policies to stabilize the economy and promote recovery. The lifting effect of these policies on the economy was positive 0.6 percentage points. Based on the forecast of inflation in Asia, policies should be prepared for the possibly more lasting core inflation. Within the context, tighter monetary policies are needed to help central banks stabilize inflation levels and expectations. Governments should be more specific when using fiscal policies to support the economy. These fiscal plans should be temporary, budget neutral and have an exit mechanism. In response to scarring effects, governments should promote structural reforms to boost growth in the medium to long term. At the same time, the increase of investment in education and training is necessary. All parties still need to address the thorny problems facing the global economy within the framework of multilateralism.

Subsequently, Mr. Torsten Ehlers and Ms. Charlotte Gardes gave keynote speeches on how to expand EMDEs’ private climate finance. They pointed out that emerging markets and developing economies have brought many challenges to private investment and need to adopt a multi-pronged approach to push for improvement across complex ecosystems.

Finally, Mr. Lian Ping delivered a speech on how China’s macro policies contribute to steady growth. Due to the uncertainties brought about by the impact of the pandemic, the slow recovery of domestic demand, the expected instability of the international economic situation and the impact of export trade, etc., the external pressure will increase in the fourth quarter of this year and next year. First of all, active fiscal policies should be put forward continuously to provide sufficient financial support for the introduction and landing of various fiscal policies, and targeted efforts should be made to support weak links, maintain moderate spending intensity, optimize the spending structure and give priority to supporting key projects. Secondly, we should maintain the sound tone of monetary policy. The implementation of the Federal Reserve’s radical monetary policy has caused impact on the world economy. Domestic monetary policy should follow it, but it is difficult to achieve with the economic downward pressure at home. It is necessary to seek a way on our own with a clear mind, and prioritize stable growth, make balanced arrangements for internal and external policies, and maintain financial market and the RMB exchange rate. Thirdly, fiscal policy and monetary policy should be well coordinated at macro, meso and micro levels to find the crux of the demand and supply problems, adhere to a steady and solid general direction, grasp the mechanism of both, flexibly choose and use the policy toolbox based on their respective advantages, dynamically adjust the functional division between macro management departments, pay attention to the market, and prevent the dynamic transmission of policy risks.

The panel discussion was chaired by Zhong Zhengsheng, Chief Economist of Ping An Securities, focusing on how China should respond to the global economy. Steven Barnett said during the discussion that although the global situation has brought negative impact on China's economy, he remains optimistic about China’s long-term economic development and further adherence to scientific economic policies. Li Xin pointed out that restoring domestic demand after the pandemic needs to mobilize resources from private sectors, stablish expectations, stabilize the overall economy from a policy perspective and implement structural reforms in the medium to long term. He went on to say that the realization of China’s modernization requires high-quality economic growth, improvement of total factor productivity and better sharing of the fruits of China's economic growth by the whole people. Yang Zirong mentioned that the main driving force behind the rapid rise in the US dollar index is the continuous and significant interest rate increase by the Federal Reserve. It is expected that the Federal Reserve will slow down the pace or even stop raising interest rates in the first half of next year, when the US dollar index may peak and fall back; The current high inflation and low unemployment rate in the United States are mainly due to the loose monetary policy and strong rescue policy in the past two years. From historical experience, the U.S. economy is likely to decline in the next one or two years. Lu Dong believes that in the short term, judging from the external economic uncertainties and cross-border capital flows, the RMB will also face depreciation, but it may be relieved through macro-prudential policies. With sufficient foreign exchange reserves, the RMB will remain relatively stable within a reasonable and balanced range. In addition, the global economy may face risks such as economic slowdown, interest rate hikes by the Federal Reserve and debt problems of low-income countries and developing countries in the world next year. It is necessary for each country to implement policies based on its own monetary system or policy mechanism to achieve a stable world economy.