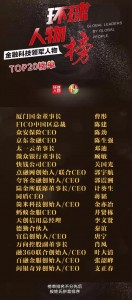

Global People Annual Grand Ceremony and Press Conference of Top20 FinTech Leaders

2016-12-18 IMI The list of the Top20 FinTech Leaders is one of the lists of Global Leaders jointly initiated by Global People and IMI. It selected the most influential FinTech leaders from a pool of 200 FinTech companies, recording the development of the era by deliberating on the stories of these pioneers.

The list of the Top20 FinTech Leaders is one of the lists of Global Leaders jointly initiated by Global People and IMI. It selected the most influential FinTech leaders from a pool of 200 FinTech companies, recording the development of the era by deliberating on the stories of these pioneers.

Ms. Xie Xiang, editor-in-chief of Global People, gave opening remarks on the conference and elaborated on the intention of initiating the list. He indicated that the internet finance is now in its full swing, and is rapidly disrupting the ways that people used to produce and live. China now has become the hub of FinTech innovation, harboring numerous FinTech companies and excellent entrepreneurs.

Ms. Xie Xiang, editor-in-chief of Global People, gave opening remarks on the conference and elaborated on the intention of initiating the list. He indicated that the internet finance is now in its full swing, and is rapidly disrupting the ways that people used to produce and live. China now has become the hub of FinTech innovation, harboring numerous FinTech companies and excellent entrepreneurs.

Prof. Ben Shenglin, dean of the Academy of Internet Finance of Zhejiang University, and executive director of IMI, gave his professional perspectives on this list and elaborated on the selection criteria behind the final results in four aspects, i.e., evaluation standard, industry distribution, reference index and methods. The evaluation is based on IPE appraisal system, with task performance and management performance as the basic indicators and acting performance as the modification indicator, which ensured the legitimacy of the evaluation.

After the announcement of the list, participants took part in a roundtable discussion centered on the themes of “opportunities for FinTech enterprises in China” and “technological finance or financial technology”. During the discussion, speakers shared their own insights and thought-provoking ideas on the topics.

Why FinTech is so popular?

In recent years, FinTech is gaining momentum in the field of internet innovation. Fintech starts from 2015, and develops by leaps and bounds in 2016. Why FinTech in so popular in China?

Prof. Ben Shenglin, dean of the Academy of Internet Finance of Zhejiang University, and executive director of IMI, gave his professional perspectives on this list and elaborated on the selection criteria behind the final results in four aspects, i.e., evaluation standard, industry distribution, reference index and methods. The evaluation is based on IPE appraisal system, with task performance and management performance as the basic indicators and acting performance as the modification indicator, which ensured the legitimacy of the evaluation.

After the announcement of the list, participants took part in a roundtable discussion centered on the themes of “opportunities for FinTech enterprises in China” and “technological finance or financial technology”. During the discussion, speakers shared their own insights and thought-provoking ideas on the topics.

Why FinTech is so popular?

In recent years, FinTech is gaining momentum in the field of internet innovation. Fintech starts from 2015, and develops by leaps and bounds in 2016. Why FinTech in so popular in China?

Greg Gibb, CEO and co-chairman of Lufax, explained the advantages of FinTech to ordinary investors in plain language. FinTech can help investors when they were lost in an ocean of various products, because it presented transparent information of all the products. FinTech platforms also evaluate the risks investors are willing to assume by assessing the investors’ information, behaviors and data provided by a third-party. Therefore, FinTech offers customers better investment opportunities, reducing costs and providing transparency.

Greg Gibb, CEO and co-chairman of Lufax, explained the advantages of FinTech to ordinary investors in plain language. FinTech can help investors when they were lost in an ocean of various products, because it presented transparent information of all the products. FinTech platforms also evaluate the risks investors are willing to assume by assessing the investors’ information, behaviors and data provided by a third-party. Therefore, FinTech offers customers better investment opportunities, reducing costs and providing transparency.

Ms. Wan Zhe, chief economist of China Gold Group, held that it is the breakthroughs in the market and regulations that enabled China to gain a rapid growth in FinTech. FinTech corrected the twisted situation from the supply side and solved the structural problems in the financial market, which is of great significance for the industry and the country.

Ms. Wan Zhe, chief economist of China Gold Group, held that it is the breakthroughs in the market and regulations that enabled China to gain a rapid growth in FinTech. FinTech corrected the twisted situation from the supply side and solved the structural problems in the financial market, which is of great significance for the industry and the country.

Mr. Guo Yuhang, the founder and co-CEO of dianrong.com presented a set of data and pointed out that there are 44 million people in the U.S. who are not covered by traditional financial market, and in China, the number is over 700-800 million. This leaves a blank in the market, and also gave FinTech a pick-up momentum. FinTech innovations such as P2P, Bitcoin, and crowdfunding have given more and more people the access to financial services. In addition, FinTech also helped enterprises to reduce their material cost, information cost and risk cost. He believes that this is “the most important opportunity for innovation”.

Mr. Guo Yuhang, the founder and co-CEO of dianrong.com presented a set of data and pointed out that there are 44 million people in the U.S. who are not covered by traditional financial market, and in China, the number is over 700-800 million. This leaves a blank in the market, and also gave FinTech a pick-up momentum. FinTech innovations such as P2P, Bitcoin, and crowdfunding have given more and more people the access to financial services. In addition, FinTech also helped enterprises to reduce their material cost, information cost and risk cost. He believes that this is “the most important opportunity for innovation”.

Ms. Qin Yi, a partner of Deloitte, introduced block chain payment software, a product co-published by Deloitte and the block chain company in May this year, which can reduce the cross-border payment costs in financially underdeveloped areas. She argued that FinTech is not just artificial intelligence, and is not just new techs such as the block chain and cloud computing, rather, it means various types of technologies combined together that allowed consumers to obtain more efficient financial services, and spare the worries from regulators. “The inclusiveness is not a service for special groups, but a concept aimed to make the whole financial consumption and services more convenient.”

How to Solve the Problems Faced by Regulators?

Despite its popularity and promising outlook, FinTech also faces bottlenecks in reality. Safety problems occur from time to time, sowing doubts among potential investors.

Indeed, safety issue is of paramount concern among FinTech enterprises. Mr. Guo suggests that FinTech companies must be very clear as to what to do and what not to do, otherwise things could fall apart. Controlling risks requires strict regulation. For example, the reason for the U.S. to achieve FinTech innovations and avert huge-scale risks at the same time lies in its sound legal basis and efficient law enforcement. In China, punishment for breaking laws is slack. It is necessary to use technology to enhance the prediction and prevention of adverse consequences, and to make sure lawbreakers can’t go with impunity.

Ms. Qin Yi, a partner of Deloitte, introduced block chain payment software, a product co-published by Deloitte and the block chain company in May this year, which can reduce the cross-border payment costs in financially underdeveloped areas. She argued that FinTech is not just artificial intelligence, and is not just new techs such as the block chain and cloud computing, rather, it means various types of technologies combined together that allowed consumers to obtain more efficient financial services, and spare the worries from regulators. “The inclusiveness is not a service for special groups, but a concept aimed to make the whole financial consumption and services more convenient.”

How to Solve the Problems Faced by Regulators?

Despite its popularity and promising outlook, FinTech also faces bottlenecks in reality. Safety problems occur from time to time, sowing doubts among potential investors.

Indeed, safety issue is of paramount concern among FinTech enterprises. Mr. Guo suggests that FinTech companies must be very clear as to what to do and what not to do, otherwise things could fall apart. Controlling risks requires strict regulation. For example, the reason for the U.S. to achieve FinTech innovations and avert huge-scale risks at the same time lies in its sound legal basis and efficient law enforcement. In China, punishment for breaking laws is slack. It is necessary to use technology to enhance the prediction and prevention of adverse consequences, and to make sure lawbreakers can’t go with impunity.

Mr. Cao Tong, Chairman of XFinTech, and former president of WeBank, believes that the regulation of FinTech sector is a topic worthy of serious consideration. The topic in itself is also a contradiction. Can the inventors and promoters of financial technology and information technology be engaged in financial businesses? If over-regulated, some technologies would lack the means to spread out. This is a fresh challenge on a global scale. Britain once proposed a “sandbox” theory, similar to the “birdcage economy” put forward by Chen Yun at the earlier period of reform and opening-up, which suggests that birds can fly in the cage, but will never be allowed to go out of the cage. This principle perhaps is suitable to the FinTech industry and is echoing the characteristics of the times.

Mr. Cao Tong, Chairman of XFinTech, and former president of WeBank, believes that the regulation of FinTech sector is a topic worthy of serious consideration. The topic in itself is also a contradiction. Can the inventors and promoters of financial technology and information technology be engaged in financial businesses? If over-regulated, some technologies would lack the means to spread out. This is a fresh challenge on a global scale. Britain once proposed a “sandbox” theory, similar to the “birdcage economy” put forward by Chen Yun at the earlier period of reform and opening-up, which suggests that birds can fly in the cage, but will never be allowed to go out of the cage. This principle perhaps is suitable to the FinTech industry and is echoing the characteristics of the times.

Mr. Guo Zhenzhou, the founder and CEO of Quark Finance, suggests that after reform and opening up, China’s government has also been moving along the tide. In the process of economic transition and adjustment, enterprises and regulators can seek a balance. Among regulators there are also some business talents with keen eyes on market changes. He said, “As a practitioner, we should actively embrace regulation and cooperate with them, instead of playing the cat-and-mouse game.”

Mr. Guo Zhenzhou, the founder and CEO of Quark Finance, suggests that after reform and opening up, China’s government has also been moving along the tide. In the process of economic transition and adjustment, enterprises and regulators can seek a balance. Among regulators there are also some business talents with keen eyes on market changes. He said, “As a practitioner, we should actively embrace regulation and cooperate with them, instead of playing the cat-and-mouse game.”

Mr. Cao Feng, CIO, vice president, and chief scientist of Hande Finmaker indicated that regulation for financial technology should avoid going extremes; it should not be too strict or too loose. “A new technology will not be able to thrive under over-tight regulations”. He recalls the period when people complained cars because horses were startled by these iron-clad monsters running on the roads. Ridiculous as it may sound today, new science and technology can often come into such dilemma. Therefore, he insists that we should hold an inclusive attitude towards the development of FinTech and allow for mild but effective regulations governing the industry.

Opportunities and Challenges Go Abreast.

In the FinTech field, to “overtake Britain and the U.S.” is not something impossible. China actually has already surpassed the U.S. in many niche markets. Mr. Zhang Shaofeng, the founder and CEO of Bairong Financial Services, cited the success of many communication products such as the mobile payment and Wechat and the popularity of internet finance as evidence of China’s leading role in the FinTech field. He believes FinTech in China enjoys a brighter future than that of the U.S.

Mr. Cao Feng pointed out that China has become a leader in app innovations, but still lags behind the U.S. in basic technology.

Mr. Cao Feng, CIO, vice president, and chief scientist of Hande Finmaker indicated that regulation for financial technology should avoid going extremes; it should not be too strict or too loose. “A new technology will not be able to thrive under over-tight regulations”. He recalls the period when people complained cars because horses were startled by these iron-clad monsters running on the roads. Ridiculous as it may sound today, new science and technology can often come into such dilemma. Therefore, he insists that we should hold an inclusive attitude towards the development of FinTech and allow for mild but effective regulations governing the industry.

Opportunities and Challenges Go Abreast.

In the FinTech field, to “overtake Britain and the U.S.” is not something impossible. China actually has already surpassed the U.S. in many niche markets. Mr. Zhang Shaofeng, the founder and CEO of Bairong Financial Services, cited the success of many communication products such as the mobile payment and Wechat and the popularity of internet finance as evidence of China’s leading role in the FinTech field. He believes FinTech in China enjoys a brighter future than that of the U.S.

Mr. Cao Feng pointed out that China has become a leader in app innovations, but still lags behind the U.S. in basic technology.

Mr. Deng Di, the chairman of TAI, compared the advantages of China and the U.S. in the FinTech field. The U.S., he suggests, has advantages in creativity, innovation, diversification, and gains an edge in the core technology and new technology. This is what we should learn from them. China’s advantages are attributed to the amount of entrepreneurs, allowing for large-scale production and operation.

Ms. Wan Zhe illustrated the opportunities and challenges facing FinTech industry in the future from a macro perspective. She noted that the G20 summit held in China is centered on themes of innovation, vitality, linkage, and inclusiveness; FinTech has all of the four characteristics. In the arena of global governance, FinTech has an essential role to play, but also poses new challenge to global governance.

Challenges and opportunities lie abreast in the future. When announcing the list, Prof. Ben Shenglin pointed out that China is taking the leading role in the FinTech field and the top 20 leaders represented the advanced level of FinTech industry both in China and in the world. For centuries, China had no chance to guide the development of any industry, but internet finance and financial technology now give China a rare opportunity to do so. China is at a critical juncture, and the leaders from internet finance and financial technology should dare to innovate, hold to their convictions and live up to the expectations and carry on.

Mr. Deng Di, the chairman of TAI, compared the advantages of China and the U.S. in the FinTech field. The U.S., he suggests, has advantages in creativity, innovation, diversification, and gains an edge in the core technology and new technology. This is what we should learn from them. China’s advantages are attributed to the amount of entrepreneurs, allowing for large-scale production and operation.

Ms. Wan Zhe illustrated the opportunities and challenges facing FinTech industry in the future from a macro perspective. She noted that the G20 summit held in China is centered on themes of innovation, vitality, linkage, and inclusiveness; FinTech has all of the four characteristics. In the arena of global governance, FinTech has an essential role to play, but also poses new challenge to global governance.

Challenges and opportunities lie abreast in the future. When announcing the list, Prof. Ben Shenglin pointed out that China is taking the leading role in the FinTech field and the top 20 leaders represented the advanced level of FinTech industry both in China and in the world. For centuries, China had no chance to guide the development of any industry, but internet finance and financial technology now give China a rare opportunity to do so. China is at a critical juncture, and the leaders from internet finance and financial technology should dare to innovate, hold to their convictions and live up to the expectations and carry on.