Macro-Finance Salon (No. 215): Fiscal policies in a warming world

2023-12-01 IMI

On October 24, 2023, the Macro-Finance Salon (No. 215), jointly organized by the International Monetary Institute of Renmin University of China and the School of Finance, was successfully conducted. The theme of this salon was “fiscal policies in a warming world”.

Mr. Ruud De Mooij, Deputy Director of the Fiscal Affairs Department of the International Monetary Fund (IMF), and Mr. Raphael Lam, Deputy Division Chief of the Fiscal Affairs Department of IMF, delivered the keynote presentation. The panel of participants included Mr. Steven Barnett, Senior Resident Representative of IMF in China; Prof. Zhong Chunping, Deputy Director of Economic Strategy Research Department of the National Academy of Economic Strategy of Chinese Academy of Social Sciences; Prof. Li Rong, Professor of the School of Finance of Renmin University of China. The salon was moderated by Zhang Zhixiang, former Director-General of the International Department of PBoC and former IMF Executive Director for China.

Mr. Ruud De Mooij introduced the climate change policies, which are the main focus of the latest International Monetary Fund's Fiscal Monitor. He emphasized that climate change has caused profound impacts on global economic and financial stability and that the IMF is deepening its focus and research on climate issues, putting it into its core work.

Mr. De Mooij pointed out that the IMF has begun to increase its focus and research on climate issues across its various departments. In the Fiscal Affairs Department, staff are conducting in-depth research on climate change as it relates to finance, while four newly developed IMF models will be used for analysis and policy development. These models can accurately assess and predict the impacts of private policies as well as the implementation and design of private policies, giving important decision support to countries in formulating policies to address climate change.

In addition, Mr. De Mooij gave a detailed presentation on a new tool, the Flexible Sustainability Trust (FST). As an innovative financial instrument closely related to climate issues, it focuses more on reform measures related to climate change than traditional forms of finance.

These measures can be either adaptive, such as public investment, climate adaptation of resilient infrastructure, etc.; or mitigating, such as energy subsidy reforms, carbon pricing reforms, etc. The design and launch of these tools further demonstrate the IMF's capacity for innovation and determination to act in the fight against climate change.

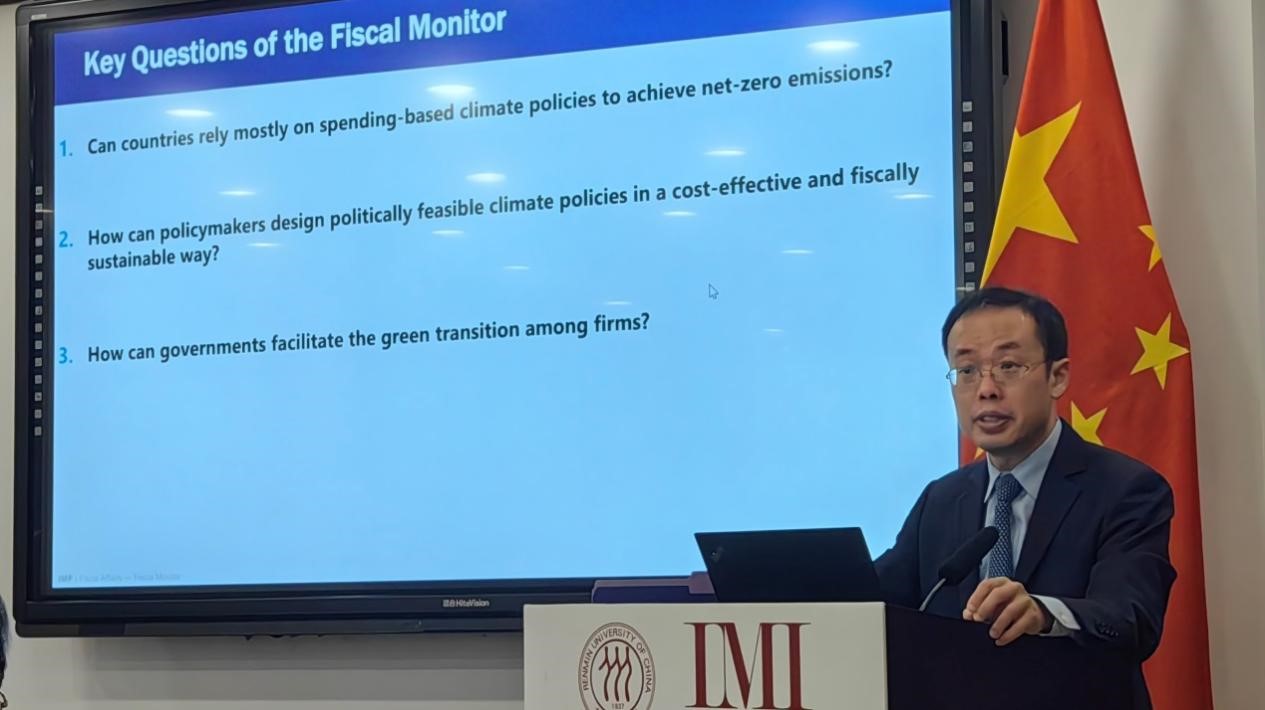

Later, Mr. Raphael Lam delivered a keynote speech on "fiscal policies in a warming world". He pointed out that, despite the measures taken by countries, there was still a large gap in achieving the goal of net-zero emissions. Public finance plays an important role in achieving this goal, and governments need to cover the costs of implementing policies.

Emphasizing the importance of carbon pricing, Mr. Raphael Lam suggested that governments should take a variety of measures to promote green development and reduce carbon emissions, but that policymakers needed to balance the political and financial impacts and find more cost-effective ways to achieve the goal. In addition, emerging markets and developing countries are facing challenges, thus they need more international support to address climate change.

Policymakers, he said, are facing a difficult trilemma. There was a need to promote the deployment of low-carbon technologies, ensure carbon price stability, and consider the impact of public finance. Meanwhile, factors such as investment bottlenecks and the time cost of green sector investments will lead to increased debt and delayed reductions in carbon emissions, resulting in higher costs. Policymakers need to carefully design green subsidies and regulatory policies to encourage businesses to invest in and adopt low-carbon technologies while leveraging the full potential of the private sector. Delays will incur significant costs, and all parties should collaborate to implement practical and effective measures to address climate change.

Raphael Lam concluded by emphasizing that climate change is a challenge faced collectively by the global community, requiring joint efforts from all countries to seek sustainable solutions. Carbon pricing is a crucial aspect, and nations need to formulate appropriate policies to promote green development and reduce carbon emissions.

In the final discussion session, Mr. Steven Barnett, Senior Resident Representative of IMF in China, Prof. Zhong Chunping, Deputy Director of Economic Strategy Research Department of the National Academy of Economic Strategy of the Chinese Academy of Social Sciences, and Prof. Li Rong, professor of the School of Finance of Renmin University of China discussed thoroughly on various issues. These included the importance of the international community collectively promoting climate resilience, innovative financing mechanisms such as Special Drawing Rights (SDR), long-term and short-term issues related to climate change and fiscal policies, as well as the costs and effects of different types of carbon policies in the forestry sector.

Translated by Xu Jiayin