Young Economists Roundtable on Money and Finance (No. 2): Credit Expansion and Asset Price

2019-03-09 IMI

Zhou Wenyuan

Zhang Jie, Director of IMI and professor from the School of Finance, Renmin University of China, first gave an opening remark. He pointed out that national strength not only lay in wealth, but also in soft powers such as thought, science, culture and institutions. If we did not understand China's history, thoughts, or philosophy, we could not explore China's present and future. Zhang also expressed his hope that new finance researchers would think independently, innovate proactively, seize new opportunities and achieve new goals as China went global.

Zhang Jie

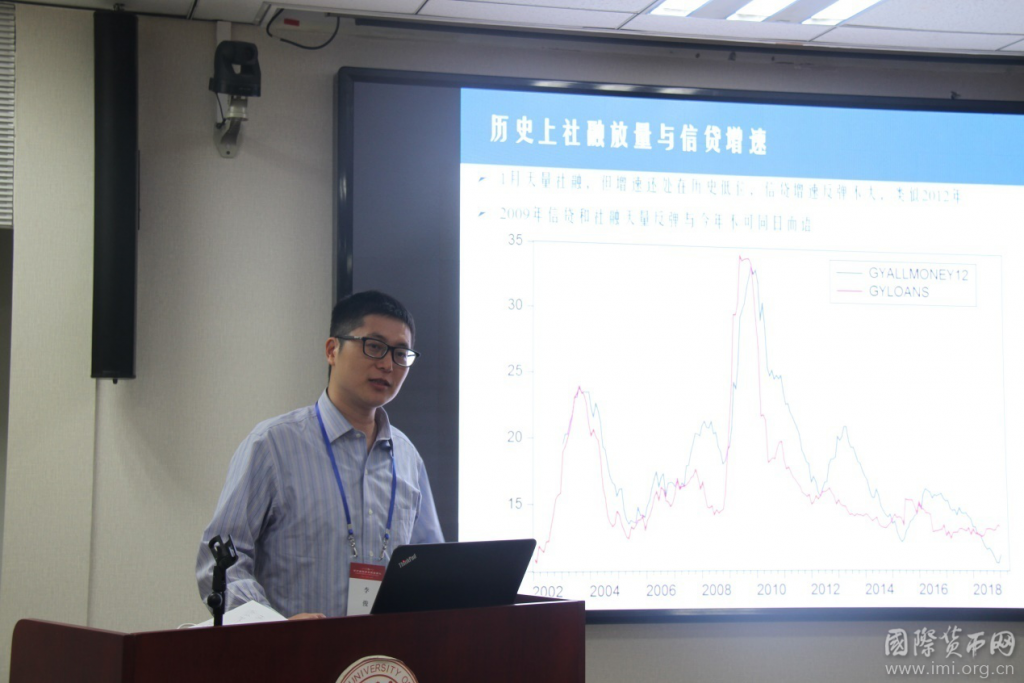

Wang Qi delivered a speech on the topic of “Credit Expansion and Asset Prices from the Perspective of Economic Cycle”. Through analyzing major manufacturers’ basic financial data, Wang pointed out that there might be a need to restart current investment of enterprises and observe follow-up changes. He thought that social financing and business cycle intertwined with each other and showed signs of reverse growth under the influence of policies issued this year. He said that the macro leverage ratio depended on whether the marginal debt increase could bring enough GDP growth or profit while current economy was recovering moderately.

Wang Qi

Li Jun shared his opinions under the theme of “Social Credit from 2009 to 2019”. He deemed that social financing structure was determined by economic structure and the structure was actually a marketization choice. From the perspective of marketization, notes financing was reasonable. And from the perspective of structure, current interest rate was also reasonable. Li said that the current growth rate of social financing was not too fast, and should continue to ease in the future. The easing process was coordination between volume and price, especially credit. He reckoned that if the interest rate and deposit reserve rate continued to decline, the capital market, especially stock price, would not be sluggish.

Li Jun

Ma Yong discussed theoretical issues of credit expansion and asset price with participants from a macro perspective. By clarifying the relations between credit expansion and asset price, as well as some indicators, Ma believed that current financial market was far from overheat. There was even no sign of recovery. In terms of the total volume, the expected low interest rate policy would remain for a long time, which provided basic financial conditions for the expansion of credit aggregates. In terms of structure, as policy became clearer, market pessimism was expected to reverse. Stock market could be the first beneficiary compared with real estate market. In terms of development stage, we were still at a preliminary stage no matter from perspectives of money, finance or economy.

Ma Yong

In addition, this seminar was also attended by Li Gang, Vice President of Pengyang AMC, Liu Chang, General Manager of Fixed Income Department, Essence Securities, Chen Hua, General Manager of Business Segment, Guoyuan Futures, Qin Long, General Manager of Fixed Income Department, Zhongtai Securities, Li Xilong, partner and Associate Director of Fixed Income Investment Department, Longlife Investment Co., Ltd., Deputy Investment Investor Director, Liang Luping from Fixed Income Department, Yinhua Fund Management Co.,Ltd., IMI research fellows including Qian Zongxin, Jiang Bo, and Jing Linde.