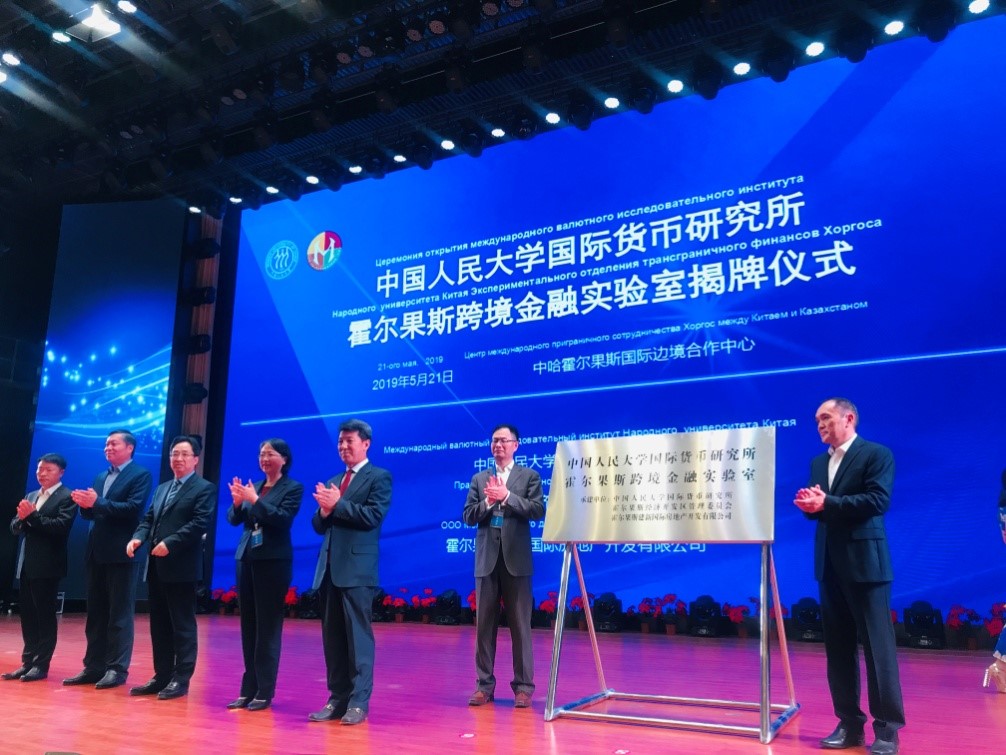

Roundtable on Money and Finance·2019 Xinjiang Forum: IMI-Khorgos Cross-border Finance Laboratory Founded

2019-05-21 IMI The IMI-Khorgos Cross-border Finance Laboratory will focus on policy research, theoretical discussion and practical innovation of cross-border finance. At the same time, it will actively explore new forms of economic and trade cooperation between China and neighboring countries, so as to lay theoretical foundation for Xinjiang to build an international financial center and a China-Central Asia Listing-Trading-Settlement Center for RMB and foreign currency. Besides, it will try to become a permanent research organization for the frontier academic research and ecosystem of cross-border finance, international cooperation, and financial innovation.

The IMI-Khorgos Cross-border Finance Laboratory will focus on policy research, theoretical discussion and practical innovation of cross-border finance. At the same time, it will actively explore new forms of economic and trade cooperation between China and neighboring countries, so as to lay theoretical foundation for Xinjiang to build an international financial center and a China-Central Asia Listing-Trading-Settlement Center for RMB and foreign currency. Besides, it will try to become a permanent research organization for the frontier academic research and ecosystem of cross-border finance, international cooperation, and financial innovation.

In the afternoon, the “Roundtable on Money and Finance · 2019 Xinjiang Forum” and the “BRI and RMB internationalization Seminar”, hosted by IMI, Xinjiang Finance Academy and the management committee of Khorgos Economic Development Zone and organized by Khorgos Jianxin International, were successfully held. Yue Yongsheng, Vice President of Xinjiang Finance Academy and Vice President of Urumqi Central Branch of PBoC, Associate Dean Zhao Xijun, Mayor Jaynes Hards and Chairman Li Junfeng delivered speeches. Chen Weidong, member of IMI Academic Committee and Director of the Institute of International Finance of BoC, Ma Jun, President of Xining Central Branch of PBoC and Qinghai Finance Academy, and Fang Xin, IMI academic member and Vice President of Chengdu Branch of PBoC and Sichuan Finance Society, delivered keynote speeches. Other guests include Luosang Zhandui, Vice President of PBoC Lhasa Central Branch, Tao Jundao, Vice President of PBoC Lanzhou Central Branch, Mei Guohui, Inspector of Beijing Management Department of PBOC, Hou Fei, Vice Manager of Global Marketing Department of BoC, Hu Yabing, Vice Manager of Financial Market Department of ICBC Head Office, Liu Xue, Assistant Manager of the General Department of Shanghai Gold Exchange, Zhang Wenzhong, Dean of School of Finance of Xinjiang University of Finance and Economics, Lu Aizhen, Director of Editorial Department of Xinjiang Finance and Economics, Wang Jiaqiang, Director of International Finance Research Institute of BoC, Li Honghan, IMI researcher and Vice Director of Management Committee of Khorgos Economic Development Zone and Xia Guangtao, Assistant Director of International Financial and Economic Research Center of Tsinghua PBoC School of Finance. The meeting was chaired by Tu Yonghong, Deputy Director of IMI.

In the afternoon, the “Roundtable on Money and Finance · 2019 Xinjiang Forum” and the “BRI and RMB internationalization Seminar”, hosted by IMI, Xinjiang Finance Academy and the management committee of Khorgos Economic Development Zone and organized by Khorgos Jianxin International, were successfully held. Yue Yongsheng, Vice President of Xinjiang Finance Academy and Vice President of Urumqi Central Branch of PBoC, Associate Dean Zhao Xijun, Mayor Jaynes Hards and Chairman Li Junfeng delivered speeches. Chen Weidong, member of IMI Academic Committee and Director of the Institute of International Finance of BoC, Ma Jun, President of Xining Central Branch of PBoC and Qinghai Finance Academy, and Fang Xin, IMI academic member and Vice President of Chengdu Branch of PBoC and Sichuan Finance Society, delivered keynote speeches. Other guests include Luosang Zhandui, Vice President of PBoC Lhasa Central Branch, Tao Jundao, Vice President of PBoC Lanzhou Central Branch, Mei Guohui, Inspector of Beijing Management Department of PBOC, Hou Fei, Vice Manager of Global Marketing Department of BoC, Hu Yabing, Vice Manager of Financial Market Department of ICBC Head Office, Liu Xue, Assistant Manager of the General Department of Shanghai Gold Exchange, Zhang Wenzhong, Dean of School of Finance of Xinjiang University of Finance and Economics, Lu Aizhen, Director of Editorial Department of Xinjiang Finance and Economics, Wang Jiaqiang, Director of International Finance Research Institute of BoC, Li Honghan, IMI researcher and Vice Director of Management Committee of Khorgos Economic Development Zone and Xia Guangtao, Assistant Director of International Financial and Economic Research Center of Tsinghua PBoC School of Finance. The meeting was chaired by Tu Yonghong, Deputy Director of IMI.

In his keynote speech, Mr. Yue Yongsheng gave a detailed introduction to the monetary cooperation between China and countries along the Silk Road. He pointed out that promoting cooperation between China and Central Asia is not only a requirement for China’s regional balanced development strategy and sustainable economic growth during the new normal period, but also an effective approach to stabilize the monetary and financial system and to realize the sustainable development of Central Asia.

In his keynote speech, Mr. Yue Yongsheng gave a detailed introduction to the monetary cooperation between China and countries along the Silk Road. He pointed out that promoting cooperation between China and Central Asia is not only a requirement for China’s regional balanced development strategy and sustainable economic growth during the new normal period, but also an effective approach to stabilize the monetary and financial system and to realize the sustainable development of Central Asia.

Jaynes Hades stressed the importance of Khorgos in building core areas of the Silk Road Economic Belt, and the key role of the Research Center of China-Kazakhstan Khorgos International Cooperation in developing cross-border finance and offshore finance and building the financial service platform along the Silk Road Economic Belt and promoting RMB internationalization. He also talked about the efforts made by the Center of China-Kazakhstan Khorgos International Border Cooperation to build the regional international financial port and international financial sub-center since the introduction of cross-border RMB innovation policy, and what has been achieved so far.

Jaynes Hades stressed the importance of Khorgos in building core areas of the Silk Road Economic Belt, and the key role of the Research Center of China-Kazakhstan Khorgos International Cooperation in developing cross-border finance and offshore finance and building the financial service platform along the Silk Road Economic Belt and promoting RMB internationalization. He also talked about the efforts made by the Center of China-Kazakhstan Khorgos International Border Cooperation to build the regional international financial port and international financial sub-center since the introduction of cross-border RMB innovation policy, and what has been achieved so far.

Zhao Xijun elaborated on the two considerations of the Symposium on BRI and RMB Internationalization: First, current international environment is undergoing profound changes with the escalating Sino-US trade frictions as the major one. Second, globalization has gained popularity, and has increased uncertainties in global economy, finance, trade, investment and external environment. The Belt and Road Initiative therefore will play an even more important role. At the end of the speech, he expressed the vision of further implementing BRI with all parties concerned to seek for a high-level opening-up.

Zhao Xijun elaborated on the two considerations of the Symposium on BRI and RMB Internationalization: First, current international environment is undergoing profound changes with the escalating Sino-US trade frictions as the major one. Second, globalization has gained popularity, and has increased uncertainties in global economy, finance, trade, investment and external environment. The Belt and Road Initiative therefore will play an even more important role. At the end of the speech, he expressed the vision of further implementing BRI with all parties concerned to seek for a high-level opening-up.

Chen Weidong noted in his keynote speech that China’s science and technology, military power, economic and financial strengths can enable other countries to realize internationalization in the future. And at the same time, monetary internationalization will also change the status of each country’s economic strength. Chen emphasized that the relative stability of exchange rate and a sustainable economic development are the prior prerequisites in the process of internationalization. Regarding the construction of RMB system, he believed that an efficient RMB liquidation system should be established; regulation and a legal system of new RMB technologies should be improved; the management of credit and liquidity risks should be further reinforced; the management rules should be strengthened.

Chen Weidong noted in his keynote speech that China’s science and technology, military power, economic and financial strengths can enable other countries to realize internationalization in the future. And at the same time, monetary internationalization will also change the status of each country’s economic strength. Chen emphasized that the relative stability of exchange rate and a sustainable economic development are the prior prerequisites in the process of internationalization. Regarding the construction of RMB system, he believed that an efficient RMB liquidation system should be established; regulation and a legal system of new RMB technologies should be improved; the management of credit and liquidity risks should be further reinforced; the management rules should be strengthened.

In his keynote speech, Ma Jun mentioned that Qinghai province and Xinjiang Autonomous Region were linked by mountains and rivers, jointly guarding the “Belt and Road”, and he also referred to the problems in the process of Qinghai promoting cross-border RMB business. He put forward four suggestions for the cross-border use of RMB. Strengthening monetary cooperation with countries along the “Belt and Road”, stepping up the development of the “Belt and Road” regional RMB offshore market and continuously strengthening RMB’s role in Hong Kong and Singapore, accelerating the building of cross-border RMB infrastructure, including cross-border RMB settlement account system and information management system, promoting the peaceful and open competition between RMB and US Dollar.

In his keynote speech, Ma Jun mentioned that Qinghai province and Xinjiang Autonomous Region were linked by mountains and rivers, jointly guarding the “Belt and Road”, and he also referred to the problems in the process of Qinghai promoting cross-border RMB business. He put forward four suggestions for the cross-border use of RMB. Strengthening monetary cooperation with countries along the “Belt and Road”, stepping up the development of the “Belt and Road” regional RMB offshore market and continuously strengthening RMB’s role in Hong Kong and Singapore, accelerating the building of cross-border RMB infrastructure, including cross-border RMB settlement account system and information management system, promoting the peaceful and open competition between RMB and US Dollar.

Fang Xin delivered a keynote speech on the issue of RMB as an international reserve currency. After RMB joined the SDR basket, we should provide RMB international markets to meet the needs of global foreign exchange reserves, avoid using current account as the only way to promote international liquidity, open up the channel for capital account to provide RMB externally, and increase the loan ratio in global RMB investment. He believed that the biggest-ever opportunity was under the “Belt and Road” framework. We could realize a stable and controllable capital circulation driven by capital account, supported by current account and through financial market. The financial market should be open not only to attract foreign capital, but also to provide suitable financial products for back-flowed RMB, rather than withdrawing it directly.

Fang Xin delivered a keynote speech on the issue of RMB as an international reserve currency. After RMB joined the SDR basket, we should provide RMB international markets to meet the needs of global foreign exchange reserves, avoid using current account as the only way to promote international liquidity, open up the channel for capital account to provide RMB externally, and increase the loan ratio in global RMB investment. He believed that the biggest-ever opportunity was under the “Belt and Road” framework. We could realize a stable and controllable capital circulation driven by capital account, supported by current account and through financial market. The financial market should be open not only to attract foreign capital, but also to provide suitable financial products for back-flowed RMB, rather than withdrawing it directly.

In the roundtable discussion, Hou Fei provided pertinent suggestions on improving cross-border policies and promoting communication mechanisms at all levels in both countries. Hu Yabing thought that how to appropriately manage RMB value is the challenge confronting RMB internationalization and large capital inflows. Wang Jiaqiang pointed out that sufficiently active transactions, stable policy expectations and abundant products are the essential factors of the market. Li Honghan believed that it was necessary to jointly promote the RMB internationalization and the exchange rate formation mechanism, especially though market-oriented approaches. Liu Xue held the view that the most important function of the exchange was to ensure the normal operation of transactions and to decide the issuing prices. Mei Guohui proposed suggestions on the establishment of IMI-Khorgos Cross-Border Financial Laboratory and raised six positions for future financial development in Khorgos. Tao Jundao mentioned that our core role was to serve the facilitation and liberalization of trade and investment. He believed we should maintain the stability of the sovereign currency and strive to form a sustainable operation mechanism. Xia Guangtao expressed his view that only by determining RMB exchange rate mechanism can we ensure that in the future, all the mechanisms formed during bilateral control period were consistent in policies and real terms. Besides that, he said, in global research, the initial conditions generally decided the future status of equilibrium entry and exchange rates. Luosang Zhandui offered unique views and advice on international trade and exchange rate formation mechanisms through personal experience in Tibet. At last, Zhang Wenzhong presented his opinions about exchange rate formation mechanism, costs, needs and risks.

In the roundtable discussion, Hou Fei provided pertinent suggestions on improving cross-border policies and promoting communication mechanisms at all levels in both countries. Hu Yabing thought that how to appropriately manage RMB value is the challenge confronting RMB internationalization and large capital inflows. Wang Jiaqiang pointed out that sufficiently active transactions, stable policy expectations and abundant products are the essential factors of the market. Li Honghan believed that it was necessary to jointly promote the RMB internationalization and the exchange rate formation mechanism, especially though market-oriented approaches. Liu Xue held the view that the most important function of the exchange was to ensure the normal operation of transactions and to decide the issuing prices. Mei Guohui proposed suggestions on the establishment of IMI-Khorgos Cross-Border Financial Laboratory and raised six positions for future financial development in Khorgos. Tao Jundao mentioned that our core role was to serve the facilitation and liberalization of trade and investment. He believed we should maintain the stability of the sovereign currency and strive to form a sustainable operation mechanism. Xia Guangtao expressed his view that only by determining RMB exchange rate mechanism can we ensure that in the future, all the mechanisms formed during bilateral control period were consistent in policies and real terms. Besides that, he said, in global research, the initial conditions generally decided the future status of equilibrium entry and exchange rates. Luosang Zhandui offered unique views and advice on international trade and exchange rate formation mechanisms through personal experience in Tibet. At last, Zhang Wenzhong presented his opinions about exchange rate formation mechanism, costs, needs and risks.