AAAT

John Mourmouras:非常规时代的中央银行货币政策独立性支持全球经济

时间:2017年03月20日 作者:John Mourmouras

导读:

一、后危机时代的货币政策

2008 年金融危机和随之而来的欧债危机改变了独立央行的运行机制。央行开始接受新的宏观审慎任务,比如,欧洲央行 2014 年后就加强了对单一经济体 和单一货币体系统性风险的防控。

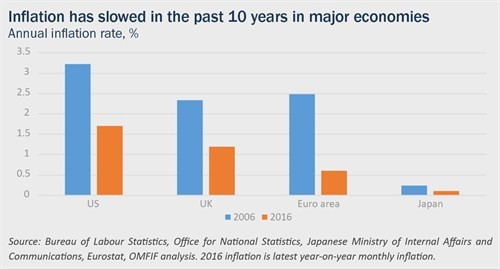

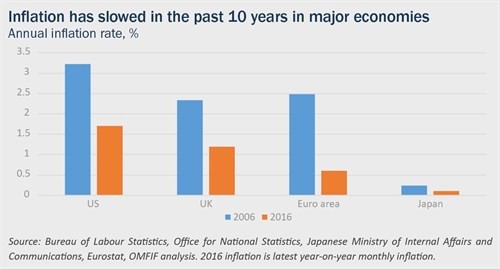

后危机时代的另一个变化是,稳定价格主要靠预防紧缩,而非遏制过度通胀。 因此,所有的主要中央银行近年来都使用了非常规的货币政策工具,包括为银行 提供紧急流动性和信贷支持,放松中短期贷款所需的“合格抵押品”的定义要求。

为了将通胀提高到目标水平,多家央行实施了负利率和量化宽松,大幅扩张 其资产负债表。2008 年以来,美联储资产负债表规模翻了一番,英格兰银行资 产负债规模则增长到三倍。欧洲央行自 2015 年实行量化宽松以来,资产负债表 规模也扩大了 66%。

二、央行独立性受到质疑

2008 年经济危机和之后的低通胀引发了对央行独立性的质疑。首先,外界 质疑央行货币政策工具的独立性。其次,即便央行的政策制定并没有受到其他机 构的干扰,但由于局势的变化,其政策未必能达到预想的效果。笔者认为,此类 质疑完全没有立足点,问题并不来自独立性本身,而是当下极度宽松的货币政策 与紧缩的财政政策并行的矛盾。

货币政策与财政政策、结构政策以及金融政策是本质相连的。制定相关政策 的机构或许形式上是各自独立的,但实质上是互相影响的。而风险就在这里,如 果某个独立的机构没能采取适当的措施达到设定的目标,另一个机构就可能对持 续的冲击采取过度的应对措施以达到自己的既定目标。这种情况可能导致其他政 策对货币政策的“弱主导作用”,破坏了独立央行意欲建立的以货币政策为主导 的体制。

当利率长期为负时,货币政策的再分配效应就会更显著,货币政策的成效是 方达标,也显得更为重要。这就引起更多针对央行独立性进行审查的呼声。人们 担心,当制定货币政策的机构被要求达到更多硬性目标时,它还能否在民主的政 治经济体制中保持透明化运行,人们还能否对其决策进行适度的问责?

一家独立的央行会受到各方制衡并须对民众负责,因此便需要民意支持。如 果负利率持续下去,央行无疑会不得民心,失掉大部分的民意支持。

独立央行的首要任务还应在于稳定价格,为结构性调整、适当的财政政策和 宏观审慎稳定创造政策空间,如此,才有可能达到恢复增长并创造就业的最终目 标——所有的理论和实证也都指明,这是唯一正确的方向。围绕央行独立性的政 策手段和目标的种种质疑不应该成为我们打破央行独立性的理由,毕竟,独立的 央行已经卓有成效地为全球经济服务了 40 多年了。

原文如下:

Central Banks in an Unconventional Era Monetary independence supports global economy John Mourmouras

The intellectual roots of central bank independence can be traced back to the rational expectations revolution. This put forward the idea that people base choices on their rational outlook, past experiences and available information. Rational expectations played a pivotal role in breaking the intellectual deadlock with addressing the ‘stagflation’ phenomenon of the 1970s, when high inflation was combined with high unemployment and slow growth.

Under discretionary monetary policy in a rational expectations framework, the interaction of private agents with the government generates an inflation bias, without any sustainable output gains. This bias increases with governments’ displeasure at the size of the output gap. As a result of this perceived bias, governments and central banks around the world moved to conduct monetary policy with a credible commitment to low inflation, anchoring inflation expectations to equally low levels.

一、后危机时代的货币政策

2008 年金融危机和随之而来的欧债危机改变了独立央行的运行机制。央行开始接受新的宏观审慎任务,比如,欧洲央行 2014 年后就加强了对单一经济体 和单一货币体系统性风险的防控。

后危机时代的另一个变化是,稳定价格主要靠预防紧缩,而非遏制过度通胀。 因此,所有的主要中央银行近年来都使用了非常规的货币政策工具,包括为银行 提供紧急流动性和信贷支持,放松中短期贷款所需的“合格抵押品”的定义要求。

为了将通胀提高到目标水平,多家央行实施了负利率和量化宽松,大幅扩张 其资产负债表。2008 年以来,美联储资产负债表规模翻了一番,英格兰银行资 产负债规模则增长到三倍。欧洲央行自 2015 年实行量化宽松以来,资产负债表 规模也扩大了 66%。

二、央行独立性受到质疑

2008 年经济危机和之后的低通胀引发了对央行独立性的质疑。首先,外界 质疑央行货币政策工具的独立性。其次,即便央行的政策制定并没有受到其他机 构的干扰,但由于局势的变化,其政策未必能达到预想的效果。笔者认为,此类 质疑完全没有立足点,问题并不来自独立性本身,而是当下极度宽松的货币政策 与紧缩的财政政策并行的矛盾。

货币政策与财政政策、结构政策以及金融政策是本质相连的。制定相关政策 的机构或许形式上是各自独立的,但实质上是互相影响的。而风险就在这里,如 果某个独立的机构没能采取适当的措施达到设定的目标,另一个机构就可能对持 续的冲击采取过度的应对措施以达到自己的既定目标。这种情况可能导致其他政 策对货币政策的“弱主导作用”,破坏了独立央行意欲建立的以货币政策为主导 的体制。

当利率长期为负时,货币政策的再分配效应就会更显著,货币政策的成效是 方达标,也显得更为重要。这就引起更多针对央行独立性进行审查的呼声。人们 担心,当制定货币政策的机构被要求达到更多硬性目标时,它还能否在民主的政 治经济体制中保持透明化运行,人们还能否对其决策进行适度的问责?

一家独立的央行会受到各方制衡并须对民众负责,因此便需要民意支持。如 果负利率持续下去,央行无疑会不得民心,失掉大部分的民意支持。

独立央行的首要任务还应在于稳定价格,为结构性调整、适当的财政政策和 宏观审慎稳定创造政策空间,如此,才有可能达到恢复增长并创造就业的最终目 标——所有的理论和实证也都指明,这是唯一正确的方向。围绕央行独立性的政 策手段和目标的种种质疑不应该成为我们打破央行独立性的理由,毕竟,独立的 央行已经卓有成效地为全球经济服务了 40 多年了。

原文如下:

Central Banks in an Unconventional Era Monetary independence supports global economy John Mourmouras

The intellectual roots of central bank independence can be traced back to the rational expectations revolution. This put forward the idea that people base choices on their rational outlook, past experiences and available information. Rational expectations played a pivotal role in breaking the intellectual deadlock with addressing the ‘stagflation’ phenomenon of the 1970s, when high inflation was combined with high unemployment and slow growth.

Under discretionary monetary policy in a rational expectations framework, the interaction of private agents with the government generates an inflation bias, without any sustainable output gains. This bias increases with governments’ displeasure at the size of the output gap. As a result of this perceived bias, governments and central banks around the world moved to conduct monetary policy with a credible commitment to low inflation, anchoring inflation expectations to equally low levels.

Monetary policy in the post-crisis period

The financial crisis of 2008 and the ensuing European sovereign debt crisis have fundamentally changed the operational framework of independent central banks. Central banks have been given new macroprudential tasks, such as the supervision of systemic banks in economic and monetary union, conducted by the European Central Bank since 2014.

Another important change is that in the post-crisis era price stability is about preventing deflation, rather than halting excessive inflation. As a result, all major central banks have employed unconventional monetary policy tools in recent years. These include the provision of emergency liquidity and credit support to banks and extending the definition of assets accepted as eligible collateral when providing loans on a short- or medium-term basis.

To help raise inflation to targeted levels, central banks have turned to negative base rates and quantitative easing, considerably expanding central bank balance sheets. Since 2008 the Fed’s balance sheet has more than doubled, while the Bank of England’s has tripled. The ECB’s balance sheet has grown 66% since its QE programme started in 2015.

Central bank challenges for independence

The legacy of the 2008 crisis and subsequent low inflation have brought challenges for central bank independence. First, external parties have questioned the independence of central bank policy instruments. Second, even if these policies are not formally challenged, they may be less likely to achieve their objectives because of the altered conditions. Such questioning is arguably aimed at the wrong target. I believe criticism should not be directed against the very concept of independence, but rather against the current economic mix of ultra-loose monetary policy with tight fiscal policy.

Monetary policy naturally interacts with fiscal, structural and financial policies. The separate authorities that conduct these policies may be formally independent, but they are also interdependent. The risk of such interdependence is that, if one independent policy authority does not take appropriate action to meet its mandated objectives, the other authorities may be obliged to overreact to persistent shocks to meet their own objectives. This may result in a regime of ‘weak dominance’ of other policies over monetary policy, effectively destabilising the regime of monetary dominance that central bank independence is meant to establish.

When interest rates are kept negative for too long, both the redistribution effects of monetary policy and the perceived degree of success of meeting the mandated objectives become more pronounced. This leads to greater demands for scrutiny of central bank independence. Concerns naturally arise about whether a monetary authority with an extended mandate of objectives can operate transparently and with appropriate accountability in a democratic political and economic system.

An independent central bank subject to checks and balances and democratic accountability needs public backing. When negative rates persist, central banks almost inevitably lose major parts of the necessary broad constituency of support.

There is still a strong overriding need for Independent central banks focused on price stability, capable of creating policy room for necessary structural adjustments, appropriate fiscal policies and macroprudential stability. All the theoretical and empirical arguments point in this direction: this approach offers the most promising path for the ultimate objective of restoring normal growth conditions and creating jobs. Controversy about the means and goals of central banking independence is no reason why the world should water down a concept that has served the global economy well over 40 years.

Monetary policy in the post-crisis period

The financial crisis of 2008 and the ensuing European sovereign debt crisis have fundamentally changed the operational framework of independent central banks. Central banks have been given new macroprudential tasks, such as the supervision of systemic banks in economic and monetary union, conducted by the European Central Bank since 2014.

Another important change is that in the post-crisis era price stability is about preventing deflation, rather than halting excessive inflation. As a result, all major central banks have employed unconventional monetary policy tools in recent years. These include the provision of emergency liquidity and credit support to banks and extending the definition of assets accepted as eligible collateral when providing loans on a short- or medium-term basis.

To help raise inflation to targeted levels, central banks have turned to negative base rates and quantitative easing, considerably expanding central bank balance sheets. Since 2008 the Fed’s balance sheet has more than doubled, while the Bank of England’s has tripled. The ECB’s balance sheet has grown 66% since its QE programme started in 2015.

Central bank challenges for independence

The legacy of the 2008 crisis and subsequent low inflation have brought challenges for central bank independence. First, external parties have questioned the independence of central bank policy instruments. Second, even if these policies are not formally challenged, they may be less likely to achieve their objectives because of the altered conditions. Such questioning is arguably aimed at the wrong target. I believe criticism should not be directed against the very concept of independence, but rather against the current economic mix of ultra-loose monetary policy with tight fiscal policy.

Monetary policy naturally interacts with fiscal, structural and financial policies. The separate authorities that conduct these policies may be formally independent, but they are also interdependent. The risk of such interdependence is that, if one independent policy authority does not take appropriate action to meet its mandated objectives, the other authorities may be obliged to overreact to persistent shocks to meet their own objectives. This may result in a regime of ‘weak dominance’ of other policies over monetary policy, effectively destabilising the regime of monetary dominance that central bank independence is meant to establish.

When interest rates are kept negative for too long, both the redistribution effects of monetary policy and the perceived degree of success of meeting the mandated objectives become more pronounced. This leads to greater demands for scrutiny of central bank independence. Concerns naturally arise about whether a monetary authority with an extended mandate of objectives can operate transparently and with appropriate accountability in a democratic political and economic system.

An independent central bank subject to checks and balances and democratic accountability needs public backing. When negative rates persist, central banks almost inevitably lose major parts of the necessary broad constituency of support.

There is still a strong overriding need for Independent central banks focused on price stability, capable of creating policy room for necessary structural adjustments, appropriate fiscal policies and macroprudential stability. All the theoretical and empirical arguments point in this direction: this approach offers the most promising path for the ultimate objective of restoring normal growth conditions and creating jobs. Controversy about the means and goals of central banking independence is no reason why the world should water down a concept that has served the global economy well over 40 years.

分享到:

扩展阅读

专家工作室EXPERTS

热门视点VIEWS

文章标签TAGS