AAAT

王卫:房地产企业高信用溢价与严格政府监管间的不匹配

时间:2019年11月22日 作者:Wang Wei

导读:

3. Unfavourable rating opinion from international rating agencies

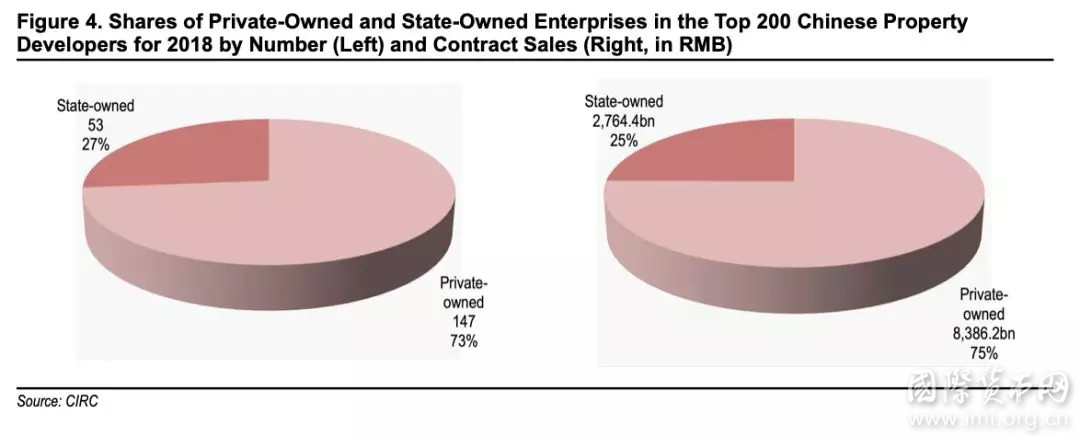

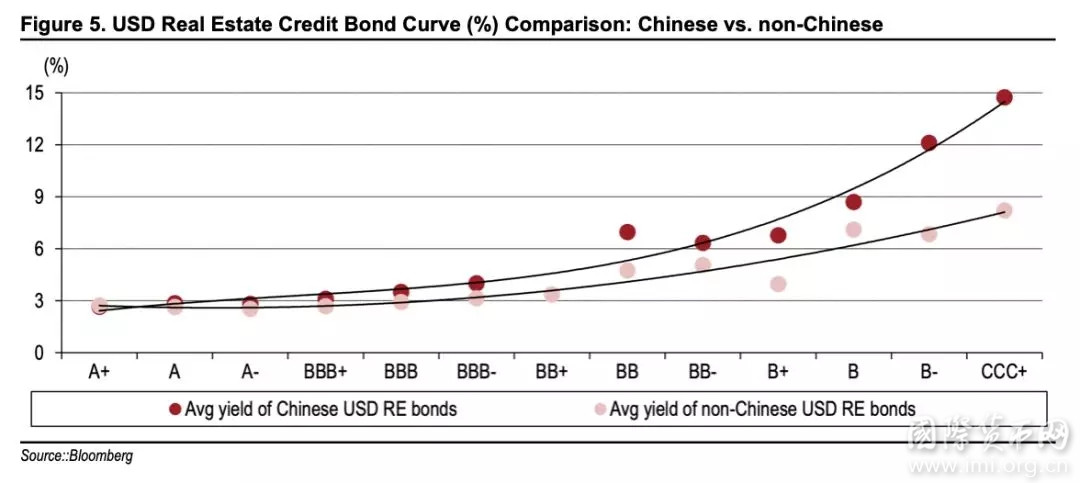

As we discussed earlier, private-owned property developers are the main force in the Chinese real estate industry, but they are mostly rated to the HY space by the three main international rating agencies, in contrast to the fact that those state-owned developers are likely to be rated into the IG space. The rationale remains to be that state-owned Chinese firms enjoy implied government support and are under better governance in additional to their financial fundamentals.

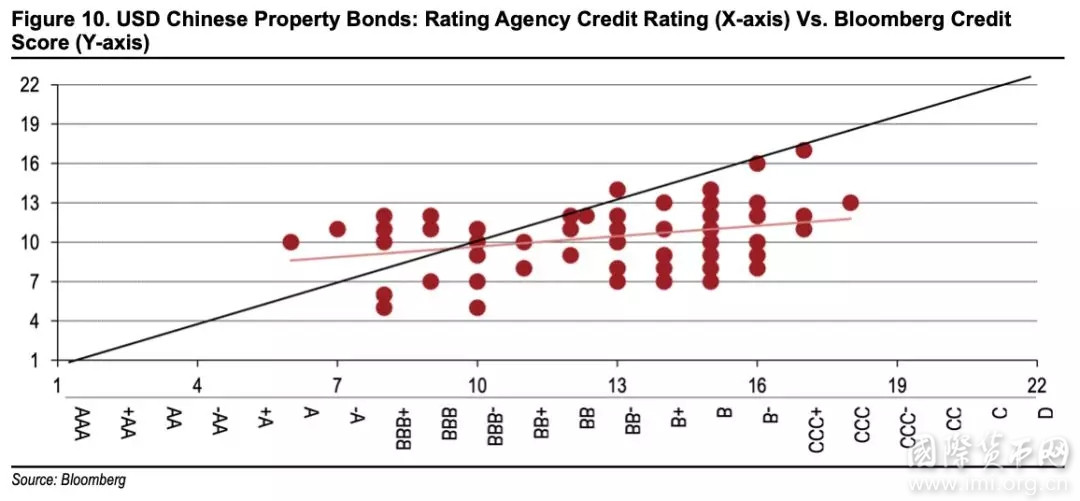

We try to quantify such rating deviations between the agency rating opinion and a fundamentals-based rating score. For a bond with more than one rating from the three main rating agencies, we use the lowest one as the bond’s composite rating representation. On the other hand, we use Bloomberg’s credit default score as a quantitatively estimated credit quality. The Bloomberg credit score measures the default probability of a company over a 1-year horizon, based on both the company’s fundamental financial strengths and its financial market performance.

In theory, both rating methodologies aimed to project the default probability of a credit entity, but their model results can be quite different (see Fig. 10). Their relationship deviates significantly from the diagonal line that represents equal credit score from the two methodologies. In details, their relationship appears to be biased in different directions between the IG and HY segments. In the IG part, the rating agencies tend to give a higher score for credit quality than the Bloomberg quantitative rating suggests, which we think is likely attributed to the fact that the rating agency model gives a considerable weight to the state-ownership factor, as most of the Chinese IG credits, including property developers, are SOEs. Yet, the Bloomberg quantitative credit model does not factor in such a consideration.

However, in the HY part, the rating agencies tend to give a lower credit quality score than the Bloomberg quantitative rating model suggests (tilting toward below the diagonal line). Since nearly all of the HY rated Chinese property developers are private-owned enterprises, they are thus lack of the implied state supportive factor in the agency model.

In our opinion, the Chinese real estate industry is a highly competitive and open-market sector, and the implied significance of the state-ownership has diminished under the current tightening policy from the government. We see no preferential treatments by any levels of government to state-owned property firms to avoid conflicts with the current policy goals.

3. Unfavourable rating opinion from international rating agencies

As we discussed earlier, private-owned property developers are the main force in the Chinese real estate industry, but they are mostly rated to the HY space by the three main international rating agencies, in contrast to the fact that those state-owned developers are likely to be rated into the IG space. The rationale remains to be that state-owned Chinese firms enjoy implied government support and are under better governance in additional to their financial fundamentals.

We try to quantify such rating deviations between the agency rating opinion and a fundamentals-based rating score. For a bond with more than one rating from the three main rating agencies, we use the lowest one as the bond’s composite rating representation. On the other hand, we use Bloomberg’s credit default score as a quantitatively estimated credit quality. The Bloomberg credit score measures the default probability of a company over a 1-year horizon, based on both the company’s fundamental financial strengths and its financial market performance.

In theory, both rating methodologies aimed to project the default probability of a credit entity, but their model results can be quite different (see Fig. 10). Their relationship deviates significantly from the diagonal line that represents equal credit score from the two methodologies. In details, their relationship appears to be biased in different directions between the IG and HY segments. In the IG part, the rating agencies tend to give a higher score for credit quality than the Bloomberg quantitative rating suggests, which we think is likely attributed to the fact that the rating agency model gives a considerable weight to the state-ownership factor, as most of the Chinese IG credits, including property developers, are SOEs. Yet, the Bloomberg quantitative credit model does not factor in such a consideration.

However, in the HY part, the rating agencies tend to give a lower credit quality score than the Bloomberg quantitative rating model suggests (tilting toward below the diagonal line). Since nearly all of the HY rated Chinese property developers are private-owned enterprises, they are thus lack of the implied state supportive factor in the agency model.

In our opinion, the Chinese real estate industry is a highly competitive and open-market sector, and the implied significance of the state-ownership has diminished under the current tightening policy from the government. We see no preferential treatments by any levels of government to state-owned property firms to avoid conflicts with the current policy goals.

分享到:

扩展阅读

专家工作室EXPERTS

热门视点VIEWS

文章标签TAGS