AAAT

阿尔贝托•奥斯纳戈Alberto Osnago:促进全球贸易流动Easing the global flow of trade

时间:2017年04月10日 作者:Alberto Osnago

导读:

二、生产网络贸易趋势

最近的PTA热和离岸外包的兴起抛出了一个问题,贸易协定是如何与全球性的生产组织形式联系起来的。理论文献的主要观点是贸易协定的“深度”与全球生产碎片化有关。相关的计量实证研究虽然不多,但都指出生产网络贸易和深度一体化之间存在正相关性一份2014年的资料显示,签署深层贸易协定会增加零部件贸易。同时,生产网络贸易的水平越高,增加签署进一步深化协定的可能性也会越大。

探讨深层PTA和企业内部离岸外包的关系时,需要考量一个关键性问题,即两国贸易协定是否与更为垂直的FDI正相关。这种促进方向可以是相互的,深层PTA可能会促进中间品贸易,加强某个生产网络潜在成员之间的FDI流动,进而有助于形成全球价值链。然而,有大量纵向FDI的企业可能会极力促成更为深化的贸易协定,以确保和增加其在伙伴国投资的盈利能力。我们的研究显示,签署更加深化的协定可以增强现有FDI的联系,同时增加新的FDI。

三、制定更合理的贸易协定

当今世界,国家之间签署了越来越多的贸易协定,公司也更加积极地参与到全球生产网络中,所以深刻理解PTA和离岸外包的关系十分有必要。我们发现的新证据表明,PTA的内容与离岸外包的模式有关。

具体而言,我们发现的证据还显示,促进国外供应商投入收缩性的条款,如监管条款,会加强PTA深度与纵向FDI的正相关关系。尽管我们的研究还有深入的余地,但是本份研究具有一定的参考价值,可以在政策制定者为支持企业融入全球价值链而制定贸易协定时起到启发作用。

原文如下:

Easing the global flow of trade

Alberto Osnago[2], Nadia Rocha[3], Michele Ruta[4]

Two economic developments have brought the relationship between preferential trade agreements and global value chains to the forefront of research and debate on trade policy. First, technological innovation in communication and transportation has enabled the unbundling of stages of production processes across time and space, resulting in an increase in offshoring. Second, since the end of the 1990s, an increasing number of countries have signed bilateral and regional PTAs.

Offshoring can be carried out either within or outside a particular company’s operations. When firms outsource the production of some stages outside their boundaries – when they engage in foreign outsourcing – they generate ‘arm’s length trade’. When they offshore within their boundaries through (vertical) foreign direct investment, they generate ‘within-firms trade’.

1.Traditional and modern PTAs

Traditional PTAs mostly consist of reciprocal market access exchanges involving tariff cuts and the reduction of other border measures. Modern-day PTAs frequently contain provisions covering a wide array of non-tariff measures, both at and behind the border. These new trade agreements are referred to as ‘deep’ to distinguish them from traditional PTAs focused solely on market access commitments – sometimes referred to as ‘shallow’ agreements.

With preferential tariffs approaching the zero lower bound, the coverage of PTAs in terms of policy areas has widened over time. The WTO documented this development in its 2011 report, ‘The WTO and preferential trade agreements: from co-existence to coherence’.

Modern PTAs increasingly contain provisions covering a wide array of non-tariff measures, both at and behind the border. For example, several PTAs include provisions covering technical barriers to trade; sanitary and phytosanitary measures; rules on investment; protection of intellectual property rights; anti-corruption provisions; competition policy; and labour regulations.

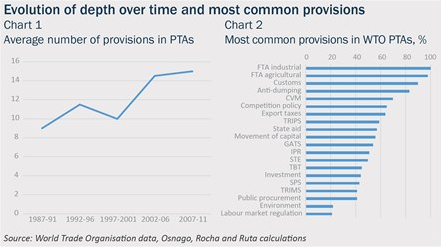

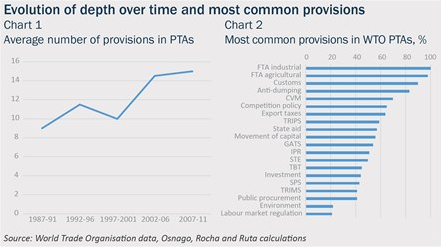

The WTO mapped a total of 52 disciplines across 100 PTAs signed between 1958 and 2011. Chart 1 shows that PTAs became deeper over time. Agreements signed between 1987 and 1991 included nine provisions on average. Agreements signed between 2007 and 2011 included an average of 15.

Chart 2 lists the 20 most common provisions included in the set of agreements mapped by the WTO. As expected, all agreements include reductions in tariffs on manufacturing goods. At the same time, more than 50% of agreements include deeper provisions such as anti-dumping and countervailing measures, rules on competition, movement of capital, and intellectual property rights. Technical barriers to trade, investment disciplines, sanitary and phytosanitary measures are often included.

二、生产网络贸易趋势

最近的PTA热和离岸外包的兴起抛出了一个问题,贸易协定是如何与全球性的生产组织形式联系起来的。理论文献的主要观点是贸易协定的“深度”与全球生产碎片化有关。相关的计量实证研究虽然不多,但都指出生产网络贸易和深度一体化之间存在正相关性一份2014年的资料显示,签署深层贸易协定会增加零部件贸易。同时,生产网络贸易的水平越高,增加签署进一步深化协定的可能性也会越大。

探讨深层PTA和企业内部离岸外包的关系时,需要考量一个关键性问题,即两国贸易协定是否与更为垂直的FDI正相关。这种促进方向可以是相互的,深层PTA可能会促进中间品贸易,加强某个生产网络潜在成员之间的FDI流动,进而有助于形成全球价值链。然而,有大量纵向FDI的企业可能会极力促成更为深化的贸易协定,以确保和增加其在伙伴国投资的盈利能力。我们的研究显示,签署更加深化的协定可以增强现有FDI的联系,同时增加新的FDI。

三、制定更合理的贸易协定

当今世界,国家之间签署了越来越多的贸易协定,公司也更加积极地参与到全球生产网络中,所以深刻理解PTA和离岸外包的关系十分有必要。我们发现的新证据表明,PTA的内容与离岸外包的模式有关。

具体而言,我们发现的证据还显示,促进国外供应商投入收缩性的条款,如监管条款,会加强PTA深度与纵向FDI的正相关关系。尽管我们的研究还有深入的余地,但是本份研究具有一定的参考价值,可以在政策制定者为支持企业融入全球价值链而制定贸易协定时起到启发作用。

原文如下:

Easing the global flow of trade

Alberto Osnago[2], Nadia Rocha[3], Michele Ruta[4]

Two economic developments have brought the relationship between preferential trade agreements and global value chains to the forefront of research and debate on trade policy. First, technological innovation in communication and transportation has enabled the unbundling of stages of production processes across time and space, resulting in an increase in offshoring. Second, since the end of the 1990s, an increasing number of countries have signed bilateral and regional PTAs.

Offshoring can be carried out either within or outside a particular company’s operations. When firms outsource the production of some stages outside their boundaries – when they engage in foreign outsourcing – they generate ‘arm’s length trade’. When they offshore within their boundaries through (vertical) foreign direct investment, they generate ‘within-firms trade’.

1.Traditional and modern PTAs

Traditional PTAs mostly consist of reciprocal market access exchanges involving tariff cuts and the reduction of other border measures. Modern-day PTAs frequently contain provisions covering a wide array of non-tariff measures, both at and behind the border. These new trade agreements are referred to as ‘deep’ to distinguish them from traditional PTAs focused solely on market access commitments – sometimes referred to as ‘shallow’ agreements.

With preferential tariffs approaching the zero lower bound, the coverage of PTAs in terms of policy areas has widened over time. The WTO documented this development in its 2011 report, ‘The WTO and preferential trade agreements: from co-existence to coherence’.

Modern PTAs increasingly contain provisions covering a wide array of non-tariff measures, both at and behind the border. For example, several PTAs include provisions covering technical barriers to trade; sanitary and phytosanitary measures; rules on investment; protection of intellectual property rights; anti-corruption provisions; competition policy; and labour regulations.

The WTO mapped a total of 52 disciplines across 100 PTAs signed between 1958 and 2011. Chart 1 shows that PTAs became deeper over time. Agreements signed between 1987 and 1991 included nine provisions on average. Agreements signed between 2007 and 2011 included an average of 15.

Chart 2 lists the 20 most common provisions included in the set of agreements mapped by the WTO. As expected, all agreements include reductions in tariffs on manufacturing goods. At the same time, more than 50% of agreements include deeper provisions such as anti-dumping and countervailing measures, rules on competition, movement of capital, and intellectual property rights. Technical barriers to trade, investment disciplines, sanitary and phytosanitary measures are often included.

2.Trends in production networks trade

The recent wave of PTAs and the surge in offshoring have raised the question of how trade agreements relate to the international organisation of production. The key insight of the theoretical literature is that the ‘depth’ of trade agreements is associated with the international fragmentation of production. Econometric studies are scarce but suggest a positive relationship between production networks trade and deep integration. According to a 2014 paper, signing deep trade agreements increases trade in parts and components. At the same time, higher levels of trade in production networks increase the likelihood of signing deeper agreements.

In terms of the relationship between deep PTAs and offshoring within the boundaries of the firm, the key question is whether the depth of trade agreements between two countries is correlated with more vertical FDI. This relationship can go in both directions. Deep PTAs may stimulate the creation of global value chains by facilitating trade of intermediate goods and FDI flows between potential members of a production network. However, firms involved in intense vertical FDI may lobby for deeper trade agreements to secure and increase the profitability of investments in partner countries. Our research shows that signing deeper agreements can boost existing FDI links and create new ones.

3.Designing better trade agreements

A better grasp of the relationship between PTAs and offshoring is important in a world where countries are signing a growing number of trade agreements and firms increasingly seek to engage in international production networks. We have found new evidence to suggest that the content of PTAs is related to the mode of offshoring.

In particular, we found evidence that the positive link between the depth of PTAs and vertical FDI is driven by the provisions that improve the contractibility of inputs provided by foreign suppliers, such as regulatory provisions. While more work is needed, this line of research contributes to an understanding of how policy-makers can design trade agreements to support firms’ integration into global value chains.

[1] This article appeared in OMFIF Bulletin (November 2016). The Official Monetary and Financial Institutions Forum (OMFIF) is a global financial think-tank, headquartered in London.

[2] Alberto Osnago is a Consultant

[3] Nadia Rocha is a Senior Economist at the World Bank

[4] Michele Ruta is a Lead Economist at the World Bank Group

2.Trends in production networks trade

The recent wave of PTAs and the surge in offshoring have raised the question of how trade agreements relate to the international organisation of production. The key insight of the theoretical literature is that the ‘depth’ of trade agreements is associated with the international fragmentation of production. Econometric studies are scarce but suggest a positive relationship between production networks trade and deep integration. According to a 2014 paper, signing deep trade agreements increases trade in parts and components. At the same time, higher levels of trade in production networks increase the likelihood of signing deeper agreements.

In terms of the relationship between deep PTAs and offshoring within the boundaries of the firm, the key question is whether the depth of trade agreements between two countries is correlated with more vertical FDI. This relationship can go in both directions. Deep PTAs may stimulate the creation of global value chains by facilitating trade of intermediate goods and FDI flows between potential members of a production network. However, firms involved in intense vertical FDI may lobby for deeper trade agreements to secure and increase the profitability of investments in partner countries. Our research shows that signing deeper agreements can boost existing FDI links and create new ones.

3.Designing better trade agreements

A better grasp of the relationship between PTAs and offshoring is important in a world where countries are signing a growing number of trade agreements and firms increasingly seek to engage in international production networks. We have found new evidence to suggest that the content of PTAs is related to the mode of offshoring.

In particular, we found evidence that the positive link between the depth of PTAs and vertical FDI is driven by the provisions that improve the contractibility of inputs provided by foreign suppliers, such as regulatory provisions. While more work is needed, this line of research contributes to an understanding of how policy-makers can design trade agreements to support firms’ integration into global value chains.

[1] This article appeared in OMFIF Bulletin (November 2016). The Official Monetary and Financial Institutions Forum (OMFIF) is a global financial think-tank, headquartered in London.

[2] Alberto Osnago is a Consultant

[3] Nadia Rocha is a Senior Economist at the World Bank

[4] Michele Ruta is a Lead Economist at the World Bank Group

分享到:

扩展阅读

专家工作室EXPERTS

热门视点VIEWS

文章标签TAGS