Steve H. Hanke:美元之浮沉The Twists and Turns of the Greenback

在2014年于维也纳召开的一场货币会议上,与我时有合作的朋友、法国人雅克·德拉罗西埃称当前的世界货币规则是“反系统”的。他的话很有道理,别的不谈,这种“反系统”带来极大的不稳定性,导致公共政策和舆论被不经思索的漫谈所左右。

最近有关货币的错误信息和虚假信息已经将人民币推上了风口浪尖。唐纳德·特朗普在和希拉里·克林顿进行的首次总统候选人辩论中,指责中国是全世界将“货币贬值”游戏玩的最好的国家,中国的出口因货币贬值大大增强。希拉里并没有提出反对,显然,她在这个问题上的观点跟特朗普如出一辙。

事实是,自从1995年以来中国的出口稳定上升,但并不是由人民币贬值驱动的。相反,人民币的名义汇率和实际汇率都略有上涨,如下图所示:

可见,那场辩论中关于人民币的言论并非事实。然而,这种言论并不只是辩论中的失言这么简单,而是由工会、各行各业商人和政治家——民主党和共和党皆有——刻意传播的虚假信息。

首次总统辩论后不久,人民币就被纳入了国际货币基金组织(IMF)的特别提款权(SDR)货币篮子,中国人自豪地认为人民币已经拥有了与美元、欧元、日元、英镑相同的地位。人民币入篮,作为中国提高人民币地位行动的重要一步,显示出人民币可能会对美元的世界首要货币地位提出严肃挑战。虽然人民币在国际上的使用高速增长,但它的发展是从零开始的。

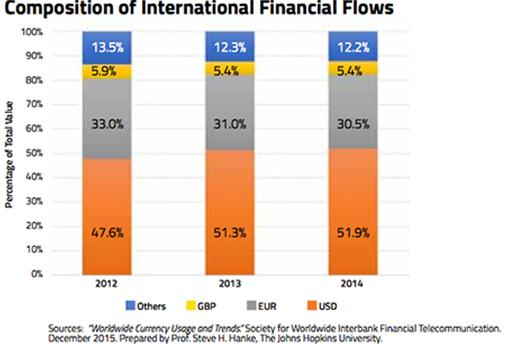

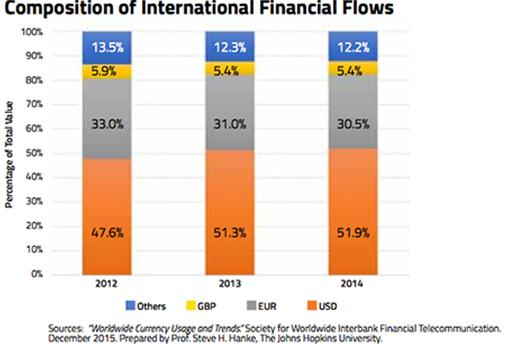

美元是货币王国的国王,在货币王国中,国王宝座是很难被夺走的。即使1999年欧元诞生,美元仍然保持了在官方储备货币中第一的位置,占据总额的63%。在外汇交易方面,美元的优势更加明显:88%的营业额都是以美元结算。美元票据在国际范围内也是广泛使用,现行流通的美元中高达三分之二的比例是流通于海外市场的。环球同业银行金融电讯协会(SWIFT)经手的所有交易中,过去几年间美元交易已经增长到全部交易的52%,见下图。

如同当年的欧元一样,人民币将会把美元挤下宝座的言论是不可靠的。在过去三千年的历史长河中,每一时期都有一个世界主导货币,其地位是很难受到挑战的。证据就在于这些货币的寿命之长,平均来看,他们已经统治世界长达300年的时间。这预示着,除非美国政府犯下致命错误或者颠覆性技术登上世界舞台,否则美元的统治还将持续不短的一段时间。这是为什么呢?

我们借鉴诺贝尔奖获得者罗伯特·蒙代尔的研究成果来回答这一问题。在研究过去三千年间的世界主导货币时,蒙代尔发现在每一时期,世界上都有一种主导货币,而每一种主导货币都有五大特征:

(一)交易域很大。

在这一点上,美国显然符合标准。直到最近为止,美国都是以购买力平价衡量的世界最大经济体。当前美国的GDP占全世界的16.1%,中国刚刚超过美国,占到16.9%,而欧元区占有11.9%。因此,从交易域看来,人民币和欧元都可以挑战美元的地位。

(二)货币政策激发国民信心。

从没有一个主导货币在高通货膨胀率或反复出现的贬值风险下保住其国际统治地位。因此,除非美国货币政策出现巨大失误,否则想挑战美元地位是徒劳的。

(三)不实行汇率控制。

像中国所实行的这种汇率控制实际上是赢弱的体现。这种控制本身就削弱了人民币对美元的挑战力,因此中国目前正在努力放开汇率管制。值得注意的是,美元正在一个领域变得越来越脆弱,即美国政府在美元使用上采取的制裁。金融制裁来源于侵略性、干涉主义、新保守主义的思想,美国将其用作一种战争武器,由财政部下属的外国资产控制局(OFAC)管理,然而OFAC却自相矛盾地向美元发动了战争。乔治·华盛顿在独立战争时期还能从英格兰银行的账户中提款的日子真是一去不复返了。

与汇率控制相关的其他类型的限制可能施加于人们如何使用或转移资金。限制某种货币使用的方法之一就是将其废弃,这是哈佛大学教授肯尼斯·罗格夫在他的新书《现金的诅咒》中提出的观点。罗格夫并非唯一一个这样想的人,原美国财政部部长、现任哈佛大学教授的拉里·萨默斯,以及明尼苏达联储原主席纳拉亚那·克彻尔拉柯塔,都提倡脱离美元现金。这样的行动可能会为挑战美元宝座打开大门。

(四)强大的国际货币一直与强大的国家联系在一起,能够保护自己不受内忧外敌的伤害是一个国家安全和稳定的保障。

(五)世界进入完全的法币时代之前,所有主导货币都留有退路,它们都可以兑换为金银。

当下成为法币的货币是无路可退的,因此面对挑战相当脆弱。也许,一项新的颠覆性技术会让有退路的私人货币的发行和使用成为可能,从而对主导货币的王座形成挑战。

关于雅克·德拉罗西埃所提出的“反系统”中美元的浮沉,2008年的大崩盘是绝好的出发点。下表记录了美元汇率在短短四个月间惊人地下滑了19.13%,由此导致了金价和油价也分别下跌19.08%和57.03%。不足为奇,美国的年度通胀率从七月份的5.5%直接转为一年后-1.96%的通货紧缩。与美联储所声称的恰恰相反,美元的波动、相关物价的变化以及通货膨胀情况显示,2008年下旬的货币政策过度收紧了,而我们至今还未能从巨大的不稳定中完全恢复。

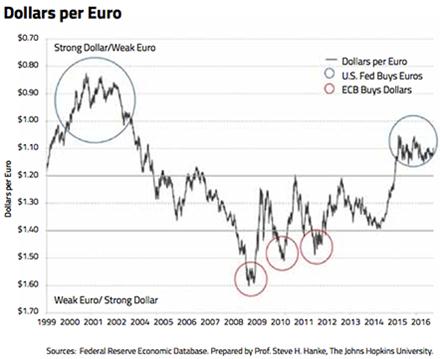

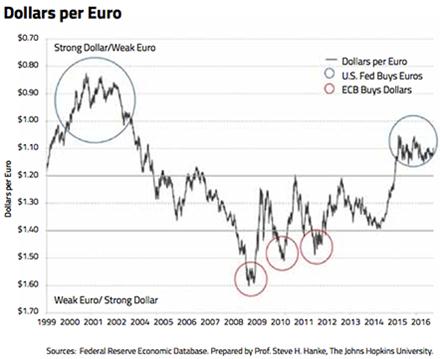

我们该如何降低当前“反系统”中的不稳定性,并将美元波动所带来的伤害最小化呢?世界最重要的两大货币——美元和欧元——应当建立正式合作协议,在一定区间内交易(例如,1欧元兑换1.2至1.4美元)。欧洲央行应在美元走弱时购买美元来保持这一汇率区间,同样若欧元走弱,美联储也将买入欧元。如果在1999年欧元问世之时就采取了这样一套系统,本应发生如下图所示(反事实的)情况。

稳定性也许不是万能的,但没有稳定性是万万不能的。

英文原文:

This article appeared in the November 2016 issue of Globe Asia.

At a monetary conference in Vienna back in 2014, the distinguished Frenchman, friend, and occasional collaborator Jacques de Larosière proclaimed that the current world monetary order should be termed an “anti-system.” He has a point — an important point. Among other things, such an anti-system invites an enormous amount of instability, as well as uninformed loose talk that influences public opinion and policy.

The Chinese yuan has been at the center of much of the recent misinformation and disinformation about currencies. During the first presidential debate between Donald Trump and Hillary Clinton, Trump fingered China as the world’s best practitioner of currency devaluations — devaluations that Trump claims power China’s exports. Clinton didn’t object to Trump’s thesis. Indeed, she boarded the same train.

The facts are that Chinese exports have steadily risen since 1995, but they have not been powered by a depreciating yuan. In fact, the yuan has slightly appreciated in both nominal and real terms. The accompanying chart tells that story.

So, what was said about the yuan during the debate is untrue. But, that yuan story is not a debate slip. It is disinformation spread by unions, mercantilist of all stripes, and politicians: Republicans and Democrats alike.

Shortly after the first presidential debate, the yuan entered the International Monetary Fund’s Special Drawing Right (SDR) basket of top-tier currencies. With that, the Chinese boasted that the yuan was now in the same league as the other SDR currencies: USD, euro, Japanese yen, and the British pound. As part of China’s yuan promotion campaign, it declared that the yuan would be a serious challenger to the greenback as the world’s premier currency. While the yuan’s international use has grown rapidly, it started with a base of zero.

The dollar is King, and when it comes to currencies, Kings are difficult to dethrone. Even after the introduction of the euro in 1999, the USD has maintained its top spot as the currency held as official reserves, accounting for 63 percent of the total. When it comes to foreign exchange trading, the dollar is even more dominant, accounting for almost 88 percent of the turnover. Dollar notes are widely used internationally, too, with as much as two-thirds of all the greenbacks in circulation circulating overseas. In terms of the transactions handled by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), the outfit that moves “money” among banks, the U.S. dollar has increased its dominance over the past few years, accounting for almost 52 percent of the total transactions (see the accompanying chart).

As with the introduction of the euro, claims that the yuan will dethrone the King are off the mark. For the past three millennia, there has always been a dominant world currency, and it’s very hard to challenge the King. This is evidenced by the longevity of dominant currencies. On average, they’ve reigned for 300 years. This would suggest that the U.S. dollar, unless the U.S. government makes a big mistake or a new disruption technology enters the stage, is probably going to be on the throne a while longer. Why?

To answer that question, we borrow from the work of Nobelist Robert Mundell. In Mundell’s study of the world’s dominant currencies over the past three millennia, he found that there was always one currency that dominated, and that the following five characteristics were associated with each dominant currency:

1.The transactions domain was large.

On this score, the U.S. clearly qualifies. Until recently, it has been the world’s largest economy measured on a purchasing power parity basis. Today, its GDP accounts for 16.1 percent of the world’s total. China has recently surpassed the U.S. on that measure, with 16.9 percent of the total, and the Eurozone has 11.9 percent. So, in terms of their transaction zones, both the yuan and the euro could challenge the greenback.

- Monetary policy inspired confidence.

No currency ever survived as a top international currency with a high rate of inflation or with a recurring risk of debasement or devaluation. So, unless there are significant U.S. monetary policy mistakes, challengers will face a Sisyphean task.

3.Exchange controls were absent. Exchange controls, such as those in China, are always a sign of weakness, not strength.

Controls alone eliminate the Chinese yuan as a challenger to the greenback’s dominance. This explains why China is working to remove controls. It is worth stressing that one of the areas where the U.S. dollar is becoming increasingly vulnerable to a challenge is the area of sanctions (read: restrictions), which the U.S. government imposes on the use of the greenback. Financial sanctions – which have been inspired by an aggressive, interventionist, neoconservative philosophy – are used by the U.S. and are administered as weapons of war by the Office of Foreign Asset Control at the U.S. Treasury (OFAC). Paradoxically, the OFAC is waging war on the U.S. dollar. Gone are the days when George Washington, in the middle of the U.S. Revolutionary War, could draw on his account at the Bank of England.

Related to exchange controls are other types of restrictions that can be placed on how people can spend and transfer the money they own. One way to restrict the use of a modern currency is to abolish it. That is just what Harvard Professor Kenneth Rogoff has proposed in his new book The Curse of Cash, which was recently published by Princeton University Press. And Rogoff is not alone. Another Harvard Professor, former U.S. Treasury Secretary Larry Summers, and Prof. Narayana Kocherlakota, who was formerly the president of the Federal Reserve Bank of Minneapolis, have also advocated moving away from greenback cash. Such a move would open the gates for a challenge to King dollar.

4.Strong international currencies have always been linked to strong states. States that can defend themselves against external and internal enemies. This is a security-stability factor.

5.Until the world entered the age of complete fiat currencies, all the dominant currencies had a fallback factor.

They were all convertible into gold or silver. So, today’s currencies, being fiat currencies, have no fallback factor, and all are vulnerable to a challenge. Perhaps a new disruptive technology will allow for the production and efficient use of a private currency with a fallback factor. Such a currency, if deemed to be legal, could mount a challenge to the King.

When viewing the twists and turns of the greenback in Jacque de Larosière’s anti-system, there is no better place to start than the Great Crash of 2008. The accompanying chart shows that the USD/€ exchange rate — the world’s most important price — fell a stunning 19.13 percent over a brief four month period. Linked to the soaring dollar, two other important prices, gold and oil, collapsed by 19.08 and 57.03 percent, respectively. Not surprisingly, the annual inflation rate in the U.S. moved from an alarming rate of 5.5 percent in July to an outright deflation of -1.96 percent a year later. Contrary to the Federal Reserve’s claims, the dance of the dollar and related changes in commodity prices and the level of inflation indicated that monetary policy was way too tight in late 2008. This caused massive instability that we still haven’t fully recovered from.

What can be done to reduce the instability in the current anti-system and mitigate the damage caused by the twists and turns of King dollar? The world’s two most important currencies — the dollar and the euro — should, via formal agreement, trade in a zone ($1.20 – $1.40 to the euro, for example). The European Central Bank would be obliged to maintain this zone of stability by defending a weak dollar via dollar purchases. Likewise, the Fed would be obliged to defend a weak euro by purchasing euros. Just what would have happened under such a system (counterfactually) since the introduction of the euro in 1999 is depicted in the accompanying chart.

Stability might not be everything, but everything is nothing without stability.