洪灝:救市会成功吗?(Market Rescue: Will It Work?)

导读:

2018年股票市场普跌的大背景下,救市措施频频出台。救市措施在一个技术性超卖的市场里提振了情绪,然而短时间的效应并不意味着救市措施的成功。IMI特约研究员,交银国际董事总经理、首席策略分析师洪灏认为,在过去两年市场回暖和影子银行盛行的背景下,大规模的质押并非完全出于民企的融资需求,尽管通过了公司法关于回购的规定,上市公司净现金只占总市值不到1%。同时,坐拥净现金的企业应该也是健康的企业。因此,它们通过公开市场回购去支持股价的需求应该不那么迫切。这些短期的救市应对策略并没有改变中国股市长期的结构性问题。

以下是文章中英对照:

《救市会成功吗?》

《Market Rescue:Will It Work?》

中国市场弥漫着一片“救市”之声,而市场自身也正在尝试技术性反弹。高层的一系列演讲,以及迅速推出并陆续执行的一系列短期应对的政策,都表明了“救市”的决心。例如,有关部门只用了四天便修改了公司法,来为上市公司回购股票提供更便利的渠道。券商被禁止强行出售那些已抵押、并已经跌到强制平仓线的股票。同时,券商还正在筹备资金以减轻那些虽然股票已经大量质押的、但是“仍有价值”公司的压力。

Shanghai reeks of calls to “bailout”, and is attempting to stage a technical rebound. The series of speeches by top policy makers, the accompanying array of new policies to stem the hemorrhage, and more importantly, the swiftness of the rollout of these policies all suggest the resolve to “rescue” the market. For instance, it only took four days for the People’s Congress to change the corporate law to make ways for stock repurchase by listed companies. Brokers are disallowed from forced selling those shares pledged but cannot meet margin calls, and they are readying funds to relieve those “worthwhile” companies of which shares are heavily pledged.

但这一系列的短期应对政策会奏效吗?

Will it work?

根据我们的统计分析显示,尽管2015年股票市场泡沫的破裂曾短暂的阻碍了股权质押的“蓬勃”发展,股权质押金额及质押比例还是从2015年初以来持续攀升。直至2018年3月份,市场整体质押比例明显上升,而后快速下滑(图1)。随着市场的不断下跌,越来越多股权质押面临平仓风险—情形就如同踩油门加速一般。

Our quantitative analysis shows that the amount of shares pledged and the percentage of total market capitalization pledged have been rising since early 2015, even though the stock market bubble burst only managed to put a fleeting dent in the share-pledge practice. The percentage of the market pledged rose until March 2018, and then began to fall sharply (Figure 1). It appears that as the market plunge accelerated, margin calls on shares pledged increased – it was like stepping on the gas pedal.

图表一: 中国大规模股票质押的困境.

Figure 1: China’s shares-pledge problem.

Source: Wind, BOCOM Int'l

尽管如此,自一月末以来,整个新兴市场一直承受着巨大的抛压。自2015年的泡沫破灭后市场复苏以来,股权质押比例随着市场的回暖而同步上升。因此,股权质押贷款不太可能是造成熊市的根本原因,尽管这些质押会加重熊味。与此同时,美国市场的剧烈波动也对本来就已经形成的熊市雪上加霜。我们的研究认为,这是中国经济短周期下行与美国经济短周期见顶冲突交汇产生的后果。(《中美周期的冲突》,20180902)

That said, given that the entire emerging market has been under pressure since late January, and that the percentage of market pledged has been rising in tandem as the market recovered from the 2015 crash, it is unlikely that these share-pledged loans are the reason for the bear market, although it must have aggravated it. Meanwhile, the surging volatility in the US market has not helped – the consequence of the colliding economic down cycle in China and the peaking cycle in the US (“The Colliding Cycles of the US and China”, 20180902).

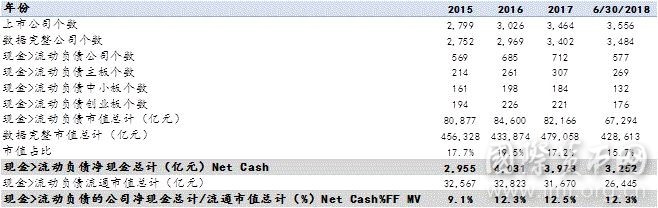

此外,火速修改并通过的公司法以允许上市企业更容易的回购股份。这个修改法案是否能够奏效?我们的研究分析显示,其实答案尚不明朗。我们认为,如果上市公司资产负债表上净现金为正值,则该公司有能力在公开市场上回收股份。我们通过比较上市公司资产负债表上的净现金流量与短期债务发现,当前所有上市公司仅有约3,250亿的净现金,相当于持有净现金对应的公司12.3%的自由流通股市值。但这些净现金只占不到整个市场40万亿元总市值的1%。 这个净现金的总量虽然已经从2016年的4000亿元左右的规模有所下降,但由于市场下跌,其相对于市场总市值的比例大致稳定(图2)。综上所示,上市公司能够用于公开回购股份的现金量其实是有限的。尽管修改后的法律能够帮助那些拥有额外现金流的公司,但这些公司本身应该比较健康,因此也可能不太倾向于通过回购的渠道去支持自己的股票。

Will the swift changes of corporate law to allow easier share repurchase work? Our analysis suggests the answer is unclear. We compare listed companies’ net cash on balance sheet with their current liabilities. If net cash is positive, the companies will have the ability to buy back shares in the open market. We find that the listed companies only have 325 billion yuan of net cash, or 12.3% of the corresponding companies’ free-float market cap, but less than 1% of the entire market’s capitalization of over 40 trillion yuan. This figure has fallen from just over 400 billion yuan, but the percentage remains stable – a result of a falling market (Figure 2). As such, the net cash that can be deployed for share buyback is limited, despite the change of law. It could help those companies with some excess cash, but these companies are strong in their own right, and thus probably less prone to support their own shares.

图表二: 上市公司净现金有限,难以展开大规模的公开市场回购

Figure 2: Listed companies have limited net cash for share repurchase.

Source: Wind, BOCOM Int'l

总而言之,这些应对的政策可能会舒缓市场低迷的人气。但它们没有触及中国股市所面临的问题的本质:中国股市并非始终是一种包容性致富的投资追求。股市的目的,并非总是通过参与上市公司的增长,让普罗大众都有创造财富的机会。相反,中国股市更像是一场“击鼓传花”的游戏,富人收割穷人,有闲阶层收割无闲,局内人收割局外人。而中国的散户投资者,通常出于一种自嘲的“阿Q”乐观主义精神,给这种游戏起了个外号,名曰“割韭菜”。这是因为韭菜长得快,可以一遍又一遍地收割。

In sum, these tactics are likely to support the subdued market sentiment. But they have not touched the essence of the issue that the China’s stock market has been confronted with – the stock market has not always been an inclusive pursuit to give the hoi polloi the opportunity to participate in wealth creation via the growth of listed companies. Instead, it has been a game of “rip-off”, of the rich over the poor, the haves over the have-nots, the insiders over the outsiders. And the Chinese retail investors, often in good spirit, nickname such a game “harvesting chives” (because chives grow fast and can be harvested over and over).

在近代历史上,中国股市有过两次大牛市——一次是在2005年年中至2007年末,另一次是在2014年年中至2015年年中。这些牛市产生的根本原因,是当时的市场结构发生了根本的变化,以至于包容了中国的散户投资者,让他们一起参与到创造财富的过程里:2005年股权分置改革解决了公共部门持有的大量限售股对市场的潜在压力;无论对错,2014年融资交易的显著增长让许多人从赤贫一跃成为巨富,虽然最后又回到了原点。

In recent history, there have been two great bull runs in the Chinese stock markets – one from mid-2005 to late-2007, and another from mid-2014 to mid-2015. The fundamental reason for these bull markets is that there was structural change prior to the inception of these bull markets - to include retail investors in the pursuit of wealth creation: in 2005, it is the stock ownership reform to resolve the status of the restricted shares held by the state; and in 2014, the significant growth of margin lending, rightly or wrongly, let a great many soar from rags to riches, and then back to earth.

对于资产类别的喜好,中国投资者往往更偏好房地产,而不是股票。过去二十多年,房地产的表现一直非常好,其原因不仅在于房地产是最合理的加杠杆的方式,甚至对普通工薪阶层也是如此。更重要的是,房地产可能是唯一的一个一直让最多人参与财富创造的公平游戏。它始于1998年的住房改革,当时国有住房产权被以象征性的价格出售,将大量财富转移给了人民群众。

The reason why the Chinese favors property as an asset class over stocks, and property has done exceedingly well is not just because property is the most legitimate way to take on leverage, even for a working class. It is because property is probably the only fair game that has been consistently letting the most number of people participate in wealth creation. It started from the housing reform in 1998, when the state transferred significant wealth to the masses through selling state-owned property titles at a token price.

两年前,在我们题为《市场底部:何时何地》的报告中,我们将市场底部重新定义为相对于长期经济增长率(报告发布于2016年六月三日)。我们发现,上证综指与1986年以来中国的五年计划里隐含的GDP增长目标之间呈对数线性关系 (图3)。在两年前的这份报告中,我们写道:如果这个历史关系持续,理论上的市场底部应该在2450左右。

In our report titled “the Market Bottom: When and Where” more than two years ago (20160604), we re-defined the market bottom as relative to a long-term economic growth rate. We showed that a log-linear relationship between the Shanghai Composite and the implicit GDP growth target implied by China’s Five-Year-Plan since 1986 (Figure 3). Interestingly, the time when Shanghai touched its bottom twice in the past, 2005 and 2014, coincided with the structural changes we discussed above. In this report two years ago, we wrote that the theoretical market bottom should be around 2,450, should the historical relationship persist.

图表三:上证运行到长期趋势线。

其长期复合增长率等于中国五年计划里隐含的GDP增长目标.

Figure 3: Shanghai is at its long-term trend line.

The ann. compound rate of the rising trend = GDP target.

Source: Bloomberg

2018年10月19日,上证综合指数暴跌至2449.197点后开始技术反弹。在过去的两年里,我们记录了一股“神秘力量”阻止上证综合指数运行到其理论底部的现象,并向高层决策者展示了我们的结论(图4)。近期,公开数据显示“国家队”已经完成了其历史的使命,全身而退。

On October 19, 2018, the Shanghai Composite plunged to 2,449.197 before it rebounded. In the past two years, we documented a mysterious force that has prevented the Shanghai Composite to arrive at its theoretical bottom, and had presented our findings to top policy makers (Figure 4). Recent public filings showed that the “National Team” had left the market.

图表四: 一股神秘力量曾在2016年阻碍上证最终触底。

上证见底是一个漫长的、反复的过程。

Figure 4: Mysterious force in 2016.

Now Shanghai is oversold, but its bottom tends to be protracted.

Source: Bloomberg, BOCOM Int'l

2013年3月17日,负责人在重要会议结束后回答媒体提问时发表评论说:“有时候,触动既得利益可能比触动灵魂更困难。”这是对中国市场面临的挑战坦率而生动的评估。在短期政策的应对性操作下,中国市场将试图修复,尽管此过程将受到海外市场大幅波动的干扰。在我们看到“触动灵魂”的结构性变化之前,大牛市的回归仍在那遥远的彼岸。

After the First Session of the Twelfth National People’s Congress on March 17, 2013, Premier Li Keqiang commented while answering questions from the press: “sometimes stirring vested interests may be more difficult than stirring the soul”. It is a candid and vivid assessment of the challenges that the Chinese market is facing. With the short-term policy tactical maneuvers, the Chinese market will attempt to heal, albeit hampered by overseas volatility. But before we see structural changes that “stir the soul”, the return of the great bull market remains elusive.