王卫:从上市公司看粤港澳大湾区的分工合作

在GBA区域内共有557家企业在中国内地交易所上市,1843家企业在海外的交易所上市,其中包括1630家在香港交易所上市的企业。

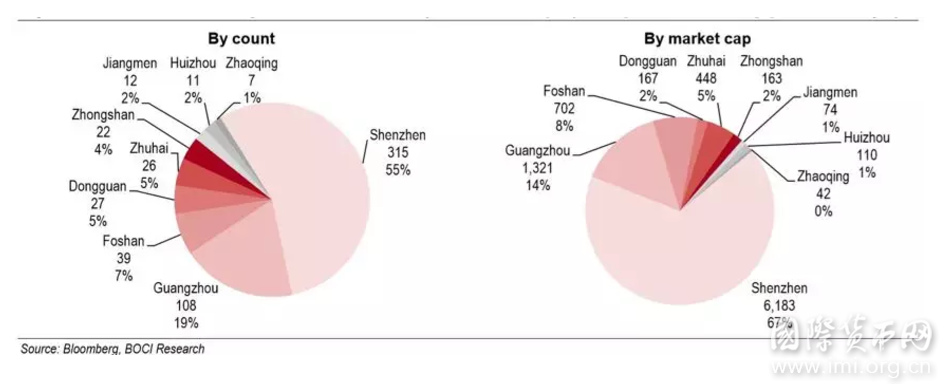

按在国内上市的公司数量,深圳占据了主导地位,达55%的份额,其次分别是广州(19%),佛山(7%),东莞(5%),珠海(5%),中山(4%),江门(2%),惠州(2%)和肇庆(1%)。而从总市值规模来看,深圳的占比更进一步,有高达67%的份额,展现了深圳的上市公司普遍具有更大的市值规模。

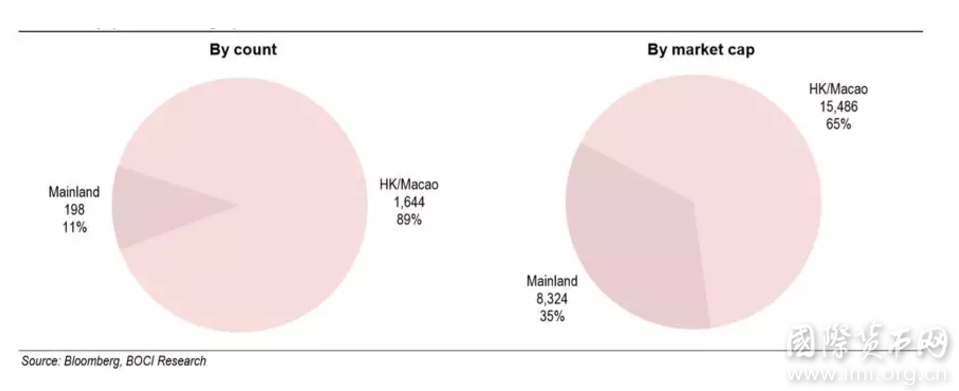

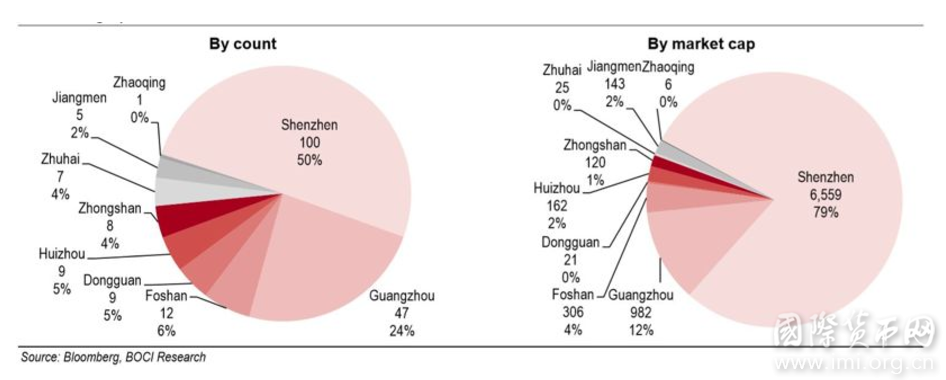

按所有海外上市公司的数据(包括双重上市公司),香港和澳门占有89%的数目份额但只占65%的市值规模。若排除香港和澳门的上市公司以外,深圳又一次在海外上市公司数量方面占据主导,有50%的份额,其次为广州(24%)和佛山(79%)。而从市值规模来看,深圳更占79%的份额,广州占12%,佛山占4%。

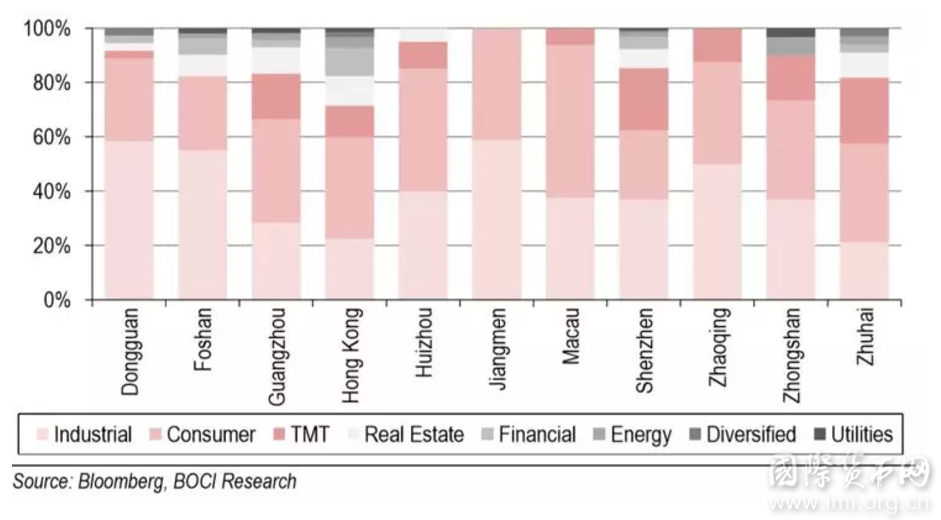

考虑这些上市公司的概况,我们发现,香港、深圳、广州、澳门、珠海此类的湾区大城市中,上市公司普遍集中在消费品及服务行业、偏科技性的电讯/传媒/技术(TMT)行业和金融服务业。对于那些较小的湾区城市,比如东莞、佛山、惠州、肇庆和江门,上市公司则更多集中在制造业领域。

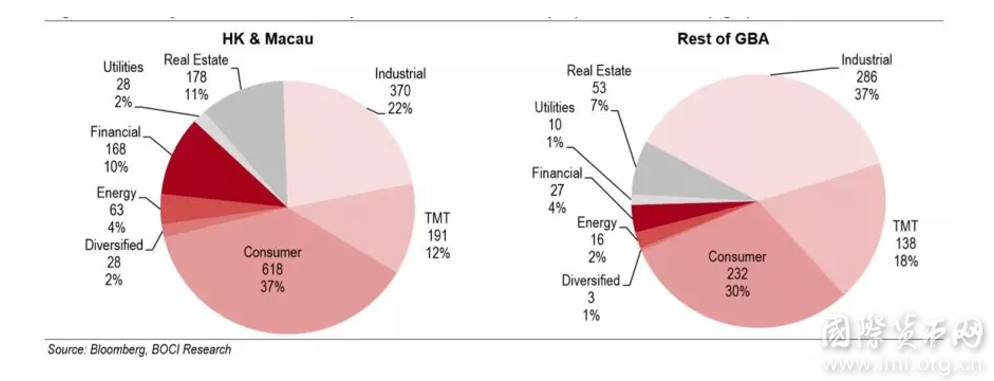

对比大陆的GBA城市群体,香港、澳门的上市公司主要集中在消费服务业,其次才是制造业。而大陆GBA城市群体中,制造业公司占主,消费类公司其次。两个城市群体的上市公司都有相当大一部分集中在TMT行业和房地产行业。就金融板块(除去房地产相关企业)而言,香港和澳门有10%的上市公司是金融企业,而大陆GBA地区只有4%的公司。

通过粤港澳大湾区上市公司的基本分布和行业特点分析,对我们思考这11个大湾区城市各自的重要性和在湾区未来经济发展机制中可能扮演的角色有一定的启发作用:香港应当继续扮演世界性的商贸和金融中心;澳门保持作为世界级的博彩和娱乐相关的休闲天堂;深圳则要成为世界级的科创中心和互补香港的区域性金融中心;广州则要进一步发展成为关键性的区域商贸中心城市;珠海和中山可以发展为地区性、与澳门互补的商业中心;而其他的GBA城市则可以成为高端制造业基地。

| 作者:王卫,IMI特约研究员,中银国际董事总经理、研究部副主管

A total of 557 companies from the GBA are listed on China’s domestic exchanges, while 1,843 GBA firms are listed on the international exchanges (including HK Exchange), including a total of 1,630 HK-registered firms.

Among the domestic listed firms, Shenzhen holds a dominant place with a 55% share, followed by Guangzhou (19%), Foshan (7%), Dongguan (5%), Zhuhai (5%), Zhongshan (4%), Jiangmen (2%), Huizhou (2%) and Zhaoqing (1%). By market cap, Shenzhen enjoys an even stronger position at 67% of the total, illustrating a larger average size of the Shenzhen listed firms.

Among the overseas listed firms (including dual-listed ones), Hong Kong/Macau dominates the table at an 89% share in the total count but only 65% in the total market cap. When excluding the HK/Macau listed firms, Shenzhen again dominates the table with a 50% share in the total count, followed by Guangzhou (24%) and Foshan (6%), or 79% in the total market cap for Shenzhen, followed by Guangzhou (12%) and Foshan (4%).

When looking into the industry profile, we find that larger cities like Hong Kong, Shenzhen, Guangzhou, Macau and Zhuhai all have high concentrations of listed firms in the consumer products & services industry, the technology-eccentric TMT industry and the financial services, while smaller cities such as Dongguan, Foshan, Huizhou, Zhaoqing and Jiangmen have higher percentages from industrial firms.

Between HK/Macau and the mainland GBA city group, HK/Macau counts consumer companies as the largest concentration of listed firms, followed by industrial corporations. In contrast, the mainland GBA city group counts industrial corporations as the highest concentration, followed by consumer companies. Both groups have sizable concentrations of listed firms in the TMT and real estate industries, while financial firms (excluding real estate) do make up 10% for HK/Macau, but only 4% for the mainland GBA cities.

Through the perspective of public listed companies, we may be able to shed some light on the outlook of each of the 11 GBA cities in their significance and role to be played for this economic powerbase. HK is expected to continue to be a world-class business and financial centre; Macau to remain a niche and unique player focusing on world-class gaming and entertainment services; Shenzhen to become a world high-tech centre and a regional financial centre complementing HK; Guangzhou to further develop into a key regional business and metro hub; Zhuhai/Zhongshan to develop into a regional business hub complementing and servicing Macau; and the rest of GBA cities to become high-end manufacturing bases.

In further details, a listed company has the power to utilise its stocks as a financing vehicle for quick fund raising and asset acquisitions that, in the end, could benefit local business investment and financial position. The wealth effect from a company go listing can also be an important boost to local economy, as the monetisation of share holdings through public listing often creates instant wealth effect from the owners of the listed company, including share-holding senior managers and other employees with stock incentives. In many cases, public floating has become the quickest way for many of the stakeholders of the company to materialise wealth and rise in the wealth rank.

Figure 1. Domestic Listed Companies from the GBA: by Total Number (left) and by Total Market Cap (in RMB bn, right)

For the overseas listed firms from the GBA (including dual listed ones), Hong Kong/Macau registered companies dominate the table (see Figure 2). A majority of these HK/Macau registered firms are HK locally-brewed enterprises (about 1,263), as compared to about 411 firms with parents based in the mainland (mainland background). Although the locally registered HK/Macau firms account for 88% of the total listed stocks in number, they only make up 63% of the pool by market cap. Again, this demonstrates the average market cap of the mainland firms listed on the overseas exchanges (HK$42bn) is larger than that of the HK/Macau firms (HK$9bn).

Figure 2. Overseas Listed Companies from the GBA (Mainland vs. HK/Macau Firms): by Total Number (left) and by Total Market Cap (in HK$ bn, right)

For the larger cities of GBA, such as Hong Kong, Shenzhen, Guangzhou, Macau, Zhuhai, the consumer products & services industry, the technology-eccentric TMT industry and the financial services industry make up the big portion of their respective pools of listed firms, while for those smaller cities, such as Dongguan, Foshan, Huizhou, Zhaoqing and Jiangmen, industrial firms represent a large portion.

In the technology-eccentric TMT area, both Shenzhen and Zhuhai boast the highest percentage, demonstrating the significance of technology for their overall economies. Guangzhou, Zhongshan, HK and Zhaoqing also feature sizable percentages.

On the other hand, real estate firms make up a sizable portion of the listed firms for many of the GBA cities and are often more significant than the typical financial sector. This marks the fact that the real estate industry in the GBA is important to the local economies. For example, HK, Guangzhou, Zhuhai, Foshan, Shenzhen and Huizhou all see real estate firms making up a good percentage for each of them.

In the aspect of financial firms, Hong Kong boasts the highest percentage. This is naturally expected as HK is truly a global financial centre. Surprisingly, however, Foshan, though by a large distance, also boasts a sizable percentage in this segment, followed by Shenzhen, Guangzhou, Zhuhai and Dongguan.

Figure 3. Overseas Listed Companies from the Mainland Cities of GBA: by Total Number (left) and by Total Market Cap (in HK$ bn, right)

HK/Macau features consumer companies as the largest group of listed firms, followed by industrial companies. In comparison, Rest of GBA has industrial companies as the largest group of listed firms, followed by consumer companies.

Away from these two largest groups, TMT is the third largest group for both regions, followed by real estate.

However, in HK/Macau, the typical financial firms (excluding real estate) do make up 10% of their listed firms, but for the Rest of GBA they only account for 4%. If we include real estate firms into the broad financial sector, the broad financial sector represents 21% for HK/Macau, but only 11% for the Rest of GBA. Obviously, the financial sector is a much more important corporate base for HK/Macau than Rest of GBA, based on the listed companies.

Figure 5. Industry Profiles of Listed Companies in GBA: HK/Macau (left) vs. Rest of GBA (right)

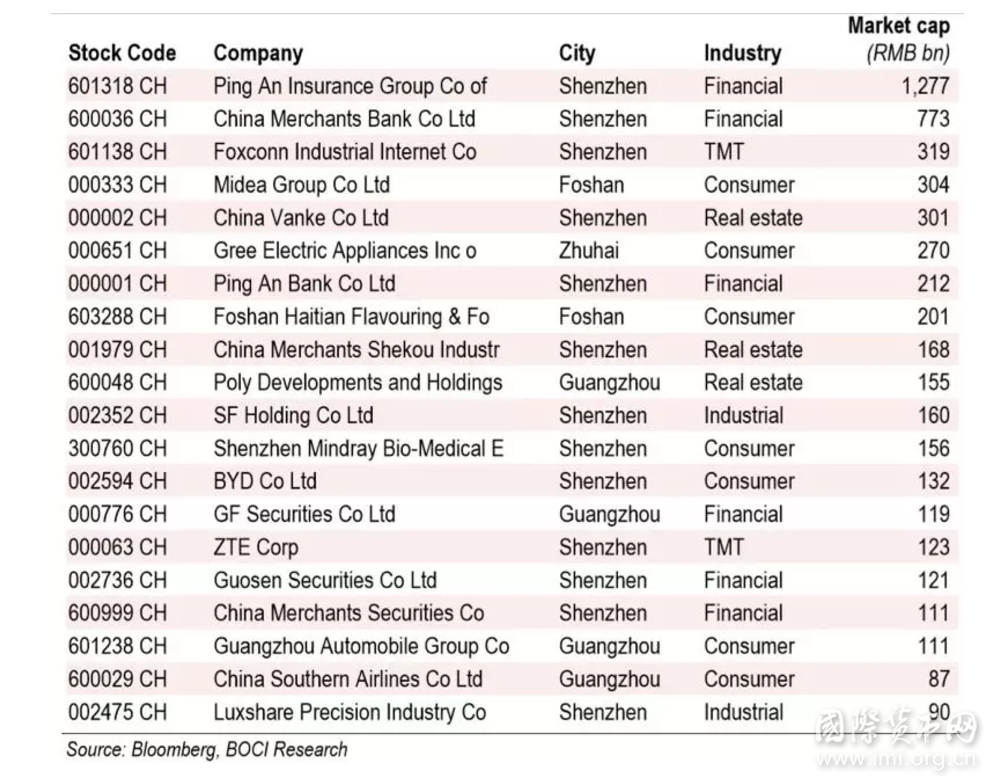

Figure 6 shows the top 20 A-share listed firms from the region. Again, Shenzhen firms dominate the table with a total number of 13, followed by Guangzhou’s 4 and Foshan’s 2. By industry, consumer products & services firms make up the most (7), followed by financials (6) and real estate (3).

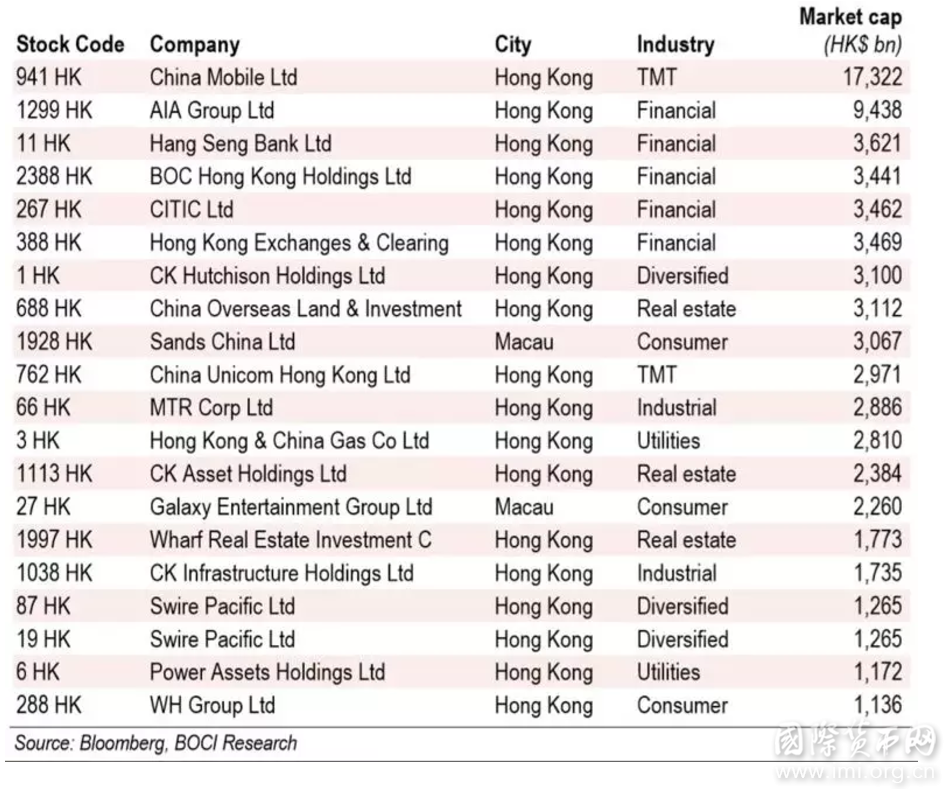

Figure 7 shows the top 20 listed firms from HK & Macau. Except two firms from Macau (in gaming/entertainment industry), the rest are all from HK. By industry sector, financials have the most (5), followed by consumer, diversified and real estate industries (all at 3), respectively.

Figure 8 shows the top 20 listed mainland firms from the GBA in the international markets. Again, Shenzhen firms lead the table with 11, followed by Guangzhou’s 5, and 1 for each of the other 4 GBA cities.

Figure 6. Top 20 Listed A-share Firms from the GBA (as of 11 March 2019)

For the ranked firms from the GBA, Shenzhen features more companies in the list than other cities of the region. Besides, its ranked companies were also generally placed higher in the ranking table. Specifically, Shenzhen boasts a total of six firms, followed by five from HK, three from Guangzhou and two from Foshan. In fact, China Evergrande Group has moved its HQ from Guangzhou to Shenzhen recently (in August 2018), and China Resources has also recently built its mainland HQ in Shenzhen, both of which are expected to further boost Shenzhen’s total Fortune Global 500 count in the next ranking survey.

Again, all of these have demonstrated the continuing rising significance and status of Shenzhen among the GBA cities.

Figure 9. 2018 Fortune Global 500 Firms from the GBA

Being an international financial centre and a key capital raising hub for both HK and mainland enterprises, HK is expected to continue to be a world-class business centre attracting companies seeking to list in HK and to set up home base in the city. By this token, HK is expected to continue its leading position in the GBA in having a high congregation of listed firms under its roof. These list firms will continue to span over a wide spectrum of the industry scope, but with a relatively sizable percentage in the financial sector.

Macau is expected to remain a niche and unique player focusing on gaming and entertainment services that offer world-class consumer experience for tourists from China and around the world.

Next in line is Shenzhen, which also has a sizable concentration of listed companies only after HK, thanks to its advantage as the first Chinese special economic zone, the home for China’s second largest stock exchange, the Shenzhen Stock Exchange, and a highly opened market. Shenzhen’s meteoric economic rise in modern Chinese history has greatly benefited from, not only the preference policies as a special economic zone, but also from a combination of other important reasons, such as its close proximity to HK, early experience from this neighbour city, the inter-city flows through economic, capital, investment and citizen exchanges between Shenzhen and HK.

Shenzhen has already demonstrated its power base in both financial and TMT industries, as the city features more Fortune Global 500 firms in these two industries than any of the other GBA cities does, including HK. We expect Shenzhen, among the GBA cities, will continue to lead in the technology-eccentric TMT industry, as well as other high-tech industries (AI, semi, healthcare, etc.), to become a world high-tech centre in the future, while also building up a regional financial centre complementing HK.

Guangzhou is expected to further develop into a key regional business and metro hub for the GBA and the southern China with its strengths in manufacturing, consumer, high-techs and real estate.

Zhuhai, plus its satellite neighbour Zhongshan, is expected to develop into a regional business hub complementing and servicing the city of Macau,

For the rest of GBA cities, most of them are expected to become high-end manufacturing bases for both China and the world, with increasing focuses on the high-value end of the supply chain and the downstream end closer to consumers.

Figure 10. Future Perspective for the GBA Cities